Advertisement|Remove ads.

November Jobs Report: Payrolls Beat Estimates, But Unemployment Ticks Higher

- Analysts expected an addition of 45,000 jobs during the month.

- The delayed report also stated that there was a decline of 105,000 jobs in October, driven by a sharp fall in federal government employment.

- BLS also revised the August payroll numbers by 22,000, showing a steeper decline of 26,000, while September’s number was revised downward by 11,000 to an increase of 108,000.

Nonfarm payrolls rose higher than expected by 64,000 in November, according to the latest report from the Bureau of Labor Statistics (BLS), which was delayed due to a government shutdown.

Analysts expected an addition of 45,000 jobs during the month, according to Dow Jones data cited by MarketWatch. The delayed report also stated that there was a decline of 105,000 jobs in October.

The decline in October nonfarm payrolls was driven by a sharp fall in federal government employment during the month. The BLS report stated that federal employment declined by 162,000 during the month, as some federal employees who accepted a deferred resignation offer came off the payroll.

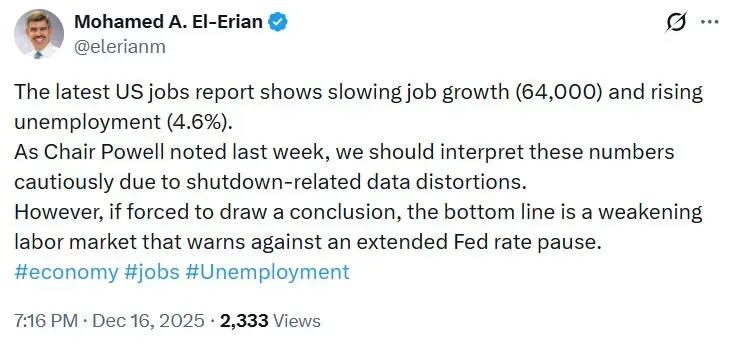

Mohamed El-Erian, Chief Economic Advisor at Allianz, highlighted in a post on X that Federal Reserve Chair Jerome Powell said that these numbers should be interpreted cautiously due to shutdown-related data distortions. Despite this, he thinks this points to a continuing labor market cooldown.

“If forced to draw a conclusion, the bottom line is a weakening labor market that warns against an extended Fed rate pause,” he said.

Downward Revision For August, September

BLS also revised the August payroll numbers by 22,000, showing a steeper decline of 26,000. The previous report stated there was a decline of 4,000 jobs during the month. Similarly, the initial count of September was revised down by 11,000, from 119,000 additions to 108,000.

Cumulatively, this is a reduction of 33,000 over the two months.

Unemployment Rate Highest Since September 2021

The unemployment rate for November was higher than expected, at 4.6%, compared to an estimate of 4.5%. This is the highest since September 2021, according to BLS data.

In particular, the jobless rate among Blacks was the highest, at 8.3%, followed by Hispanics at 5%, Whites at 3.9%, and Asians at 3.6%. Jobless rates among adult men and women stood at 4.1%, while for teenagers, it was at 16.3%.

The agency also said it was unable to collect the data needed to calculate the October unemployment rate due to the government shutdown.

Health Care, Construction Drive Gains

The BLS jobs report also revealed that while health care continued to trend up in payroll additions, the federal government jobs continued to decline. Health care added 46,000 jobs, construction jobs grew by 28,000 during the month, while social assistance added 18,000 roles.

Transportation and warehousing lost 18,000 jobs, while federal government employment fell by 6,000.

Average hourly earnings for all employees on private nonfarm payrolls edged up by $0.05 to $36.86. Over the past 12 months, average hourly earnings have risen by 3.5%.

Meanwhile, U.S. equities declined in Tuesday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.37%, the Invesco QQQ Trust ETF (QQQ) declined 0.06%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) fell 0.43%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up 0.21% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)