Advertisement|Remove ads.

US Steel Jumps On Report Of New Cleveland-Cliffs, Nucor Bid: Retail Sentiment Turns Bullish

Shares of U.S. Steel Corp. (X) jumped over 8% in morning trading Monday after a CNBC report surfaced of a potential bid involving Cleveland-Cliffs Inc. (CLF) and Nucor Corp. (NUE), barely a week after the White House blocked a $14 billion takeover attempt by Japan’s Nippon Steel.

According to the report, Cleveland-Cliffs is collaborating with rival Nucor on a proposal to acquire U.S. Steel, improving retail sentiment on Stocktwits.

The deal reportedly involves Cleveland-Cliffs purchasing U.S. Steel for an all-cash sum and divesting U.S. Steel's Big River Steel subsidiary to Nucor.

The report also stated that the proposed transaction would keep U.S. Steel’s headquarters in Pittsburgh, aligning with prior regulatory concerns.

Shares of Cleveland-Cliffs and Nucor rose more than 3.5% in early trading on the news.

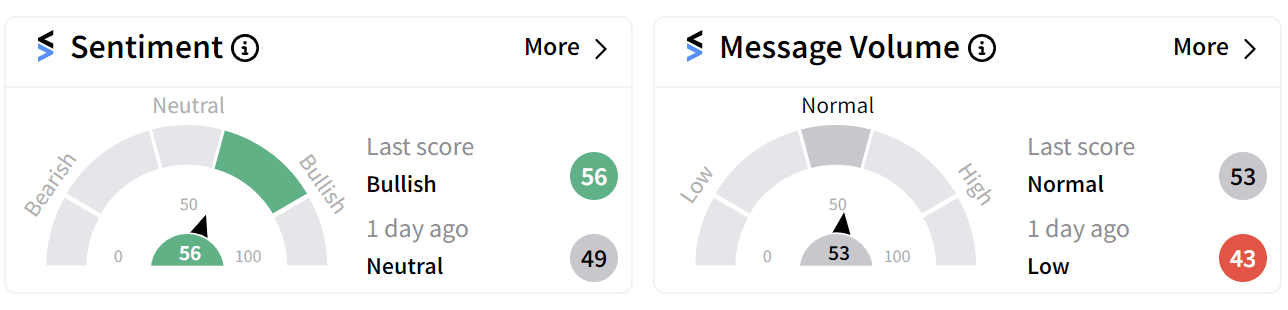

On Stocktwits, retail sentiment around U.S. Steel's shares improved to ‘bullish’ territory from ‘neutral’ a day ago. Message volume increased to ‘normal’ from ‘low’ levels.

The update comes after the White House, over the weekend, extended the deadline for Nippon Steel to permanently terminate its acquisition pursuit until June 2025. The decision follows lawsuits filed by U.S. Steel and Nippon challenging President Biden’s initial move to block the deal.

U.S. Steel and Nippon have also filed a separate lawsuit against Cleveland-Cliffs, its CEO Lourenco Goncalves, and United Steelworkers President David McCall, alleging they colluded to block the deal.

At the time of writing, neither U.S. Steel nor Nucor and Cleveland-Cliffs have commented on the report.

Some Stocktwits users believe Cleveland-Cliffs’ leadership’s close ties to President-elect Donald Trump could ease the deal’s approval.

Others argue that the new bid strengthens Nippon and U.S. Steel’s collusion allegations against Cleveland-Cliffs.

A more cautious perspective warns that if U.S. Steel rejects this bid, it could face financial instability, potentially leading to bankruptcy.

Many users criticized the rumored offer price as too low, with some calling it inadequate to reflect the company’s potential value.

U.S. Steel has struggled with a 22% decline in share value over the past year, weighed down by the prolonged regulatory hurdles surrounding its merger with Nippon Steel, which was announced in December 2023 but ultimately blocked.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read more: Barrick Gold Stock Dips On Mali Gold Seizure Amid Revenue Dispute: Retail Divided

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)