Advertisement|Remove ads.

Vail Resorts Surges After-Hours On Q2 Earnings Beat, Yet Retail Sentiment Turns Icy

Shares of Vail Resorts rose 2.9% in after-hours trading on Monday following better-than-expected fiscal second-quarter earnings, but retail sentiment soured.

The company's earnings per share were $6.56, above the consensus estimates of $6.29. Its second-quarter revenue was $1.14 billion, in line with analyst estimates.

Vail Resorts is on track to achieve its two-year resource efficiency transformation plan announced in September 2024, according to a company statement.

The plan includes $100 million in annualized cost efficiencies by the end of its 2026 fiscal year.

For fiscal 2025, Vail projects net income between $257 million and $309 million and earnings before interest, tax, depreciation, and amortization (EBITDA) between $841 million and $877 million.

"We are pleased with our overall results for the quarter, with 8% growth in resort reported EBITDA compared to the prior year," said Kirsten Lynch, Vail Resorts' CEO.

"Our results reflect the stability provided by our season pass program, our investments in the guest experience, and the strong execution of our teams across all of our mountain resorts."

"Second quarter visitation at our North American resorts was slightly above prior year levels with the benefit of improved conditions, partially offset by the expected continued industry demand normalization and the shift in destination guest visitation to the spring," she added.

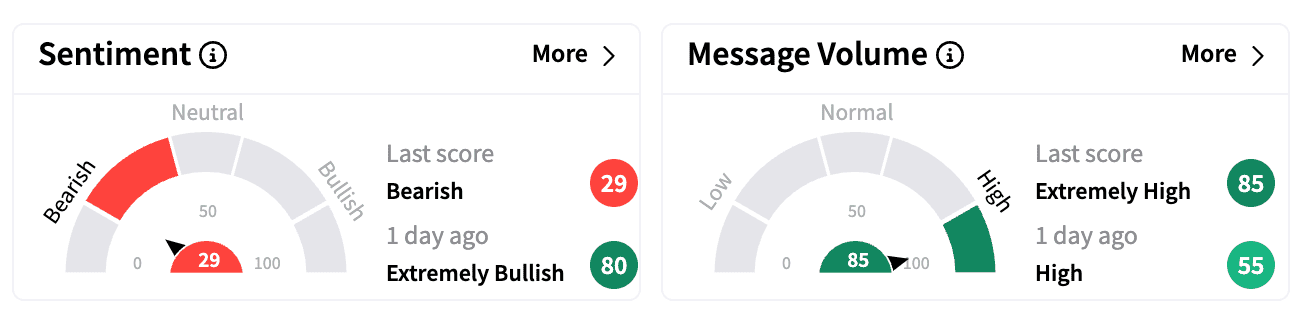

Sentiment on Stocktwits ended Monday at a 'bearish' level versus 'extremely bullish' a day ago, while message volume rose to 'extremely high' from 'high.'

According to interim data on ski season metrics for its North American resorts and ski areas, the company’s retail and rental revenue was down 2.9% compared to the same period in the prior year, while season-to-date total skier visits were down 2.5% compared to the same period last fiscal.

"Similar to the drivers in the second quarter, season-to-date results through March 2, 2025 reflect strong local visitation from improved early season conditions with destination visitation impacted by industry demand normalization and an expected shift in destination guest visitation to the spring," Lynch added.

Vail Resorts stock is down 18% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)