Advertisement|Remove ads.

Vedanta’s Dividend Delusion: Retail Investors May Be Ignoring The Red Flags, Says SEBI RA Nikhil Gangil

SEBI-registered analyst Nikhil Gangil has flagged the disconnect between Vedanta’s financial headlines and the underlying risks that retail investors may be overlooking.

Gangil observed that the company’s consistent dividend payout has attracted retail investors, with the number of small investors nearly doubling – from 9 lakh to 20 lakhs – in the past five to seven quarters.

However, this enthusiasm marks some real concerns. Vedanta’s debt remains elevated at ₹75,000 crore while its market capitalization stands at ₹1,73,000 crore.

Gangil also highlighted that the promoter holding is reportedly 100% pledged, and there has been a notable reduction in promoter stake: about 12% sold over the last four to five quarters. These are indicators of a potential liquidity stress.

Despite robust financial performance in FY25, the company’s valuation seems stretched, he noted.

On Wednesday, Vedanta’s borad approved a first interim dividend of ₹7 per share for FY26. On the same day, it offloaded a 1.71% stake in its subsidiary Hindustan Zinc for ₹3,323 crore via block deals.

At the time of writing, Vedanta's shares were down by over 3%.

Gangil drew parallels to cautionary tales such as Gensol, emphasizing that the trend of dividend announcements and retail purchasing indicates that prioritizing immediate returns over balance sheet analysis is wishful thinking, not value investing.

He urges investors to be more cautious and focus on value over desire for returns.

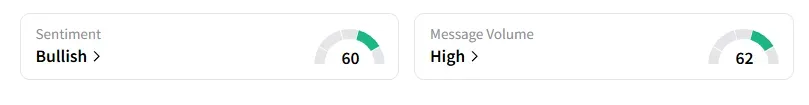

Meanwhile data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week amid ‘high’ message volumes.

Vedanta shares are down 0.5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)