Advertisement|Remove ads.

Ventyx Biosciences Stock: Retail Buzz Spikes After Phase 2 Win In Obesity And Heart Risk Study

- The Phase 2 trial showed VTX3232 cut key inflammation markers like hsCRP by about 78% and IL-6 to below risk thresholds, reinforcing its anti-inflammatory potential.

- Combination treatment with semaglutide led to further reductions in liver inflammation and cardiovascular biomarkers, with no major safety issues reported.

- On Stocktwits, retail traders debated whether VTX3232 holds greater promise as a combo therapy than a standalone drug.

Retail chatter around Ventyx Biosciences surged late Wednesday after the biotechnology company announced positive topline results from a Phase 2 study of its oral anti-inflammatory drug, VTX3232, in participants with obesity and cardiovascular risk factors.

Strong Reductions In Inflammatory Markers

The study followed 175 participants in the trial, which tested VTX3232 as both a standalone therapy and alongside semaglutide. These were compared to placebo groups.

In a statement, Ventyx said those taking the drug demonstrated strong evidence of an anti-inflammatory effect of the drug as evidenced by reductions in two biomarkers of cardiovascular risk, high-sensitivity C-reactive protein (hsCRP) and interleukin-6 (IL-6).

In the monotherapy group, hsCRP levels decreased by approximately 78% by week 12, in contrast to an increase observed in the placebo group. Levels of IL-6 also dropped to below 1.65 nanograms per liter, which is a marker for lower heart risk.

The firm also said the drug reduced levels of lipoprotein(a), fibrinogen, and liver inflammation, showing signs of an anti-inflammatory effect across multiple measures.

Expert View

CEO Raju Mohan said the observed effects on hsCRP, IL-6, and Lp(a) suggest VTX3232 could represent a new class of oral anti-inflammatory therapies.

Peter Libby, MD of Mass General Brigham, said elevated CRP levels are a strong predictor of cardiovascular risk and that new NLRP3 inhibitors may complement cholesterol-lowering treatments.

Chief Medical Officer Mark Forman said VTX3232 “robustly inhibited the NLRP3 pathway,” adding that combination treatment with semaglutide achieved further reductions in inflammation-related biomarkers.

Stocktwits Traders See Combo Potential

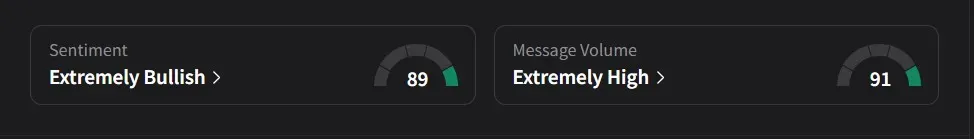

On Stocktwits, retail sentiment for Ventyx was ‘extremely bullish’ amid an 18,600% surge in 24-hour message volume.

One user expressed “mixed feelings” about the results, noting that while the data showed little effect on weight, liver disease (MASH), or lipids, VTX3232 appeared to be a strong candidate for use in combination therapies rather than as a standalone drug. They added that longer studies would be needed to define its target patient group and assess its value as a monotherapy.

Another user highlighted the company’s strong financial position, pointing out that Ventyx holds nearly $3 per share in cash and carries minimal debt.

Ventyx’s stock has risen 76% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)