Advertisement|Remove ads.

Vera Therapeutics Enters $500M Credit Facility As It Nears FDA Filing For Kidney Disease Drug: Retail Sees Stock Touching $40

Shares of Vera Therapeutics, Inc. (VERA) were in the spotlight on Tuesday morning after the company announced that it has entered into a new credit facility providing for up to $500 million of term loans with its current partner, Oxford Finance LLC.

The new credit facility will replace Vera’s existing $50 million credit facility. The initial funding of the new credit facility will be in a principal amount of $75 million and is expected to occur on June 4, 2025, the company said.

The new credit facility features a lower interest rate, increasing capital availability and financial flexibility, the company stated.

Vera Therapeutics is looking to submit a Biologics License Application to the U.S. Food and Drug Administration in the fourth quarter of this year for Atacicept. The company is looking forward to the potential commercialization of the investigational drug for the treatment of immunoglobulin A nephropathy (IgAN) in adults.

IgA nephropathy, also known as Berger's disease, is a kidney disease where antibodies build up in the kidneys, causing inflammation and damage.

Vera on Monday said that Atacicept achieved a 46% reduction from baseline in protein levels in the urine of 431 adults with IgA nephropathy being evaluated in a late-stage trial.

VERA stock closed 67% higher on Monday on the news.

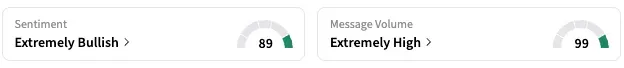

On Stocktwits, retail sentiment around VERA stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘extremely high’ levels.

A Stocktwits user praised the company’s decisions.

Another expects the stock will hit $40 soon.

VERA stock is down by 25% this year and by about 21% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237441231_jpg_b3b4b09b87.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)