Advertisement|Remove ads.

Vermillion Energy Stock In Spotlight After Q4 Sales Miss, Retail Pins Hopes On German Assets

Vermillion Energy (VET) stock garnered retail attention on Wednesday after it missed fourth-quarter sales estimates.

According to FinChat data, the company posted fourth-quarter oil and gas sales of C$504.3 million, while analysts, on average, expected the company to post C$526.6 million in sales.

It reported a net loss of C$18.3 million compared with a loss of C$803.1 million in the year-ago quarter.

Vermillion’s total production averaged 83,536 barrels of oil equivalent per day (boe/d) compared with 87,597 boe/d a year earlier.

The decline in production was due to a planned third-party maintenance activity in Alberta, partial shut-in of some Canadian gas production in response to weak prices. This was partially offset by increased production from Mica Montney.

Production at Vermilion's international operations averaged 31,243 boe/d during the fourth quarter, an increase of 3% from the previous quarter. This was due to a full quarter of production in Australia following planned maintenance in the third quarter.

The company successfully tested the Wisselshorst deep gas exploration well in Germany in December. Vermilion expects to begin production from the well in the first half of 2026.

It also completed drilling operations on the Weissenmoor Sud deep gas exploration well and found hydrocarbons, which marked its third fossil fuel discovery in Germany.

U.S.-listed shares of Vermillion rose 1.7% in extended trading.

During the first quarter of 2025, Vermilion launched a sales process for its Southeast Saskatchewan and Wyoming assets. The assets have a combined production of about 15,000 boe/d.

As it closed its acquisition of Westbrick Energy, the company raised its 2025 production forecast to the range of 125,000 to 130,000 boe/d.

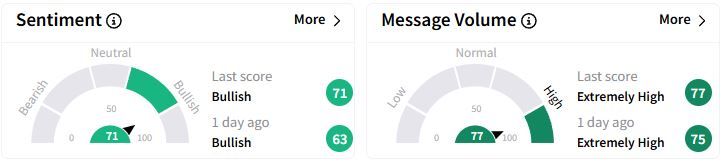

Retail sentiment on Stocktwits moved higher into the ‘bullish’ (71/100) territory than a day ago, while retail chatter was ‘extremely high.’

One retail user wished for share prices to remain low, which would help them to buy more. The trader was optimistic about Vermillion’s German assets.

Over the past year, Vermillion stock has fallen 33.8%.

Also See: LandBridge Stock Slips After Q4 Revenue Miss, Retail’s Still Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)