Advertisement|Remove ads.

VF Corp's Q2 Results Send Stock Soaring But Retail Sentiment Takes Beating

Shares of apparel, footwear and accessories company VF Corp. ($VFC) rallied hard in premarket trading on Tuesday following the release of fiscal year 2025 second-quarter results that surpassed expectations.

Denver, Colorado-based VF Corp. reported second-quarter adjusted earnings per share (EPS) of $0.60 compared to the $0.63 reported a year-ago. The bottom-line performance came in way ahead of the consensus estimate of $0.38 per share.

Revenue fell 6% year-over-year (YoY) to $2.8 billion but exceeded Wall Street estimate of $2.72 billion. The pace of YoY decline improved from the 10% drop seen in the first quarter.

The company said second-quarter results marked YoY sequential improvement relative to the first quarter, with all key metrics in line with, or above the consensus estimates.

Gross margin climbed 120 basis points from last year to 52.3% but operating margin fell 210 basis points to 9.9%.

VF Corp ended the quarter with 13% lower inventories than in the year-ago period.

Looking ahead, the company guided third-quarter revenue in the range of $2.7 billion to $2.75 billion, which represents a 1%-3% year-over-year decline in reported dollars. It expects a 100-basis-point negative impact from forex.

VF Corp maintained its 2025 cash flow from continuing operations, plus proceeds from non-core physical assets sales, of about $425 million.

The board announced a quarterly dividend of $0.09 per share, payable on December 18, to shareholders of record at the close of business on December 10.

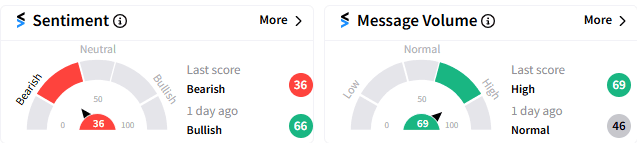

Retail sentiment flipped to ‘bearish,’ with the sentiment score on Stocktwits at 36/100 compared to 66/10 a day ago. Message volume, however, improved to ‘high.’

Following the results, JPMorgan and Barclays raised their respective price targets for the VF Corp’s shares, the Fly reported.

The former nudged up its price target from $16 to $17, and the latter from $22 to $25 and maintained an ‘Overweight’ rating. Barclays analysts expressed comfort with the company’s quarter showing progress, with revenue, margin and earnings beats, and inventory discipline.

The below-consensus operating margin was due to investments made to accelerate future growth, the analysts said.

JPMorgan, however, noted that the second-half outlook was about 70% below the consensus estimate.

In premarket trading as of 6:25 a.m. ET, VF Corp. jumped 22.08% to $20.79.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)