Advertisement|Remove ads.

VF Corp Stock Slips Despite Q3 Earnings Beat: Retail Sentiment Brightens

Shares of apparel brands company VF Corp ($VFC) slipped more than 3% on Wednesday despite a third-quarter earnings beat, but retail sentiment turned bullish.

VF Corp posted earnings per share of $0.57, above consensus analyst estimates of $0.34, according to Fly.com. Its revenue came in at $2.8 billion, up 2% from last year, beating expectations of $2.75 billion quoted by Wall Street analysts.

Net income stood at $167.78 million compared to a net loss of $42.45 million in the same quarter last year.

According to the company, its turnaround initiatives have begun to bear results, with almost all brands seeing a strong quarter. The company expects the second half to be broadly in line with expectations.

“We made strong progress in Q3'25, improving profitability and further strengthening the balance sheet. The pace of VF's transformation is on track as we deliver against our Reinvent Priorities,” Bracken Darrell, president and CEO, said. “Although there is work to do to consistently deliver double-digit operating margins and sustainable top-line growth, we are making great strides in transforming VF into a truly differentiated, multi-brand operator.”

For the fourth quarter, it expects revenue to fall by 4% to 6% from last year, with an adjusted operating loss of up to $30 million. The company reaffirmed its FY2024 free cash flow outlook of $600 million, citing higher-than-expected proceeds from the sale of non-core physical assets and improved core fundamentals.

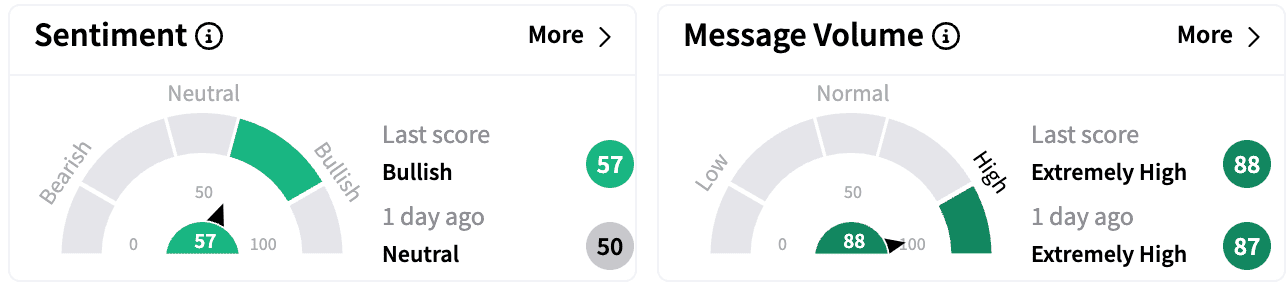

Sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago. Message volumes continued to be in the ‘extremely high’ zone.

Truist analyst Joseph Civello raised the firm's price target to $24 from $20 with a ‘Hold’ rating, Fly.com reported. The firm sees VF Corp’s management as progressing well on its turnaround efforts and has taken a prudent view by keeping expectations low in the near term. According to the analyst, even as The North Face and Timberland outperformed, softer Q4 guidance implies that pull-forward was a key driver in Q3.

VF Corp is a maker of apparel, footwear, and accessories in the outdoor, active, work segments.

VF Corp stock is up 19% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_artificial_intelligence_jpg_7c39349f2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Crypto_com_dcfe1eaba6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)