Advertisement|Remove ads.

Viatris Q1 Earnings Exceed Wall Street Expectations, Company Raises Full-Year Profit Outlook: Retail’s Positive

Shares of Viatris Inc. (VTRS) traded 9% higher on Thursday afternoon after the company reported first-quarter (Q1) earnings above Wall Street expectations and raised its full-year profit outlook.

The healthcare company reported total revenues of $3.25 billion, down 11% from the corresponding period of 2024, but above an analyst estimate of $3.24 billion, per Koyfin data.

The revenue drop was primarily driven by the “negative Indore impact.” In December, the U.S. FDA restricted the import of 11 products into the U.S. from its plant in Indore, India, following an inspection, citing violations of good manufacturing practices.

In developed and emerging markets, the company’s net sales dropped 11% and 13%, respectively. Sales in China, meanwhile, rose by 2% to $555.5 million.

Generic drug sales slumped 16% to $1.13 billion while branded drug product sales fell 8% to $2.12 billion.

Adjusted earnings per share (EPS) for the quarter came in at $0.50, down from $0.67 reported in Q1 2024, but above an analyst estimate of $0.49.

As announced in February this year, the company now expects full-year total revenues of $13.5 billion to $14 billion.

However, the firm increased its FY25 adjusted EPS guidance to $2.16 to $2.30 from its previous guidance of $2.12 to $2.26, including the impact of share repurchases.

The company said the forecast, however, excludes any potential impact from future tariffs and trade restrictions, noting that “they cannot be reasonably forecasted.”

Separately, the company also announced positive results from its late-stage trials for a contraceptive dermal patch and a pain drug on Thursday.

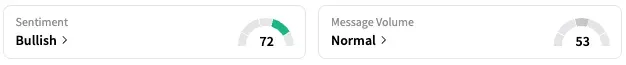

On Stocktwits, retail sentiment around VTRS stayed unmoved within the ‘bullish’ territory over the past 24 hours while message volume jumped from ‘low’ to ‘normal’ levels.

VTRS stock is down by nearly 24% this year and about 20% over the past 12 months.

Also See: Kenvue Reports Upbeat Q1 Earnings, Revises Outlook: But Retail’s Unmoved

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)