Advertisement. Remove ads.

Visa Stock Rises On Deal To Buy Payments Protection Tech Firm Featurespace: Retail Bullish Amid DOJ Antitrust Suit

Payments giant Visa Inc (V) is set to acquire AI-powered payments protection technology firm Featurespace. Visa believes the acquisition will strengthen its portfolio of fraud detection and risk-scoring solutions used by clients around the world. Shares of Visa were up over 1% on Thursday following the announcement.

The firm hasn’t disclosed the deal size but expects the transaction to close in fiscal year 2025. Featurespace was founded in 2008 and is backed by global investors including Chrysalis Investments, Highland Europe, IP Group plc, Insight Partners, MissionOG, and TTV Capital.

Visa highlighted that Featurespace’s algorithmic-based solutions can analyze transaction data and detect even the most elusive fraud cases.

Antony Cahill, Global Head of Value-added Services at Visa, said Featurespace's strong foundation in AI will enhance its existing product portfolio.

The announcement comes at a time when the Justice Department has filed a civil antitrust lawsuit against the payments giant for monopolization and other unlawful conduct in debit network markets. The complaint alleges that Visa illegally maintains a monopoly over debit network markets by using its dominance to suppress the growth of competitors and preventing others from coming out with new and innovative alternatives.

The complaint stated that over 60% of debit transactions in the United States run on Visa’s debit network, which allows it to charge over $7 billion in fees each year for processing those transactions.

According to Attorney General Merrick B. Garland, Visa has unlawfully gained the power to charge fees that far exceed what it could charge in a competitive market. “Merchants and banks pass along those costs to consumers, either by raising prices or reducing quality or service. As a result, Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything,” he said.

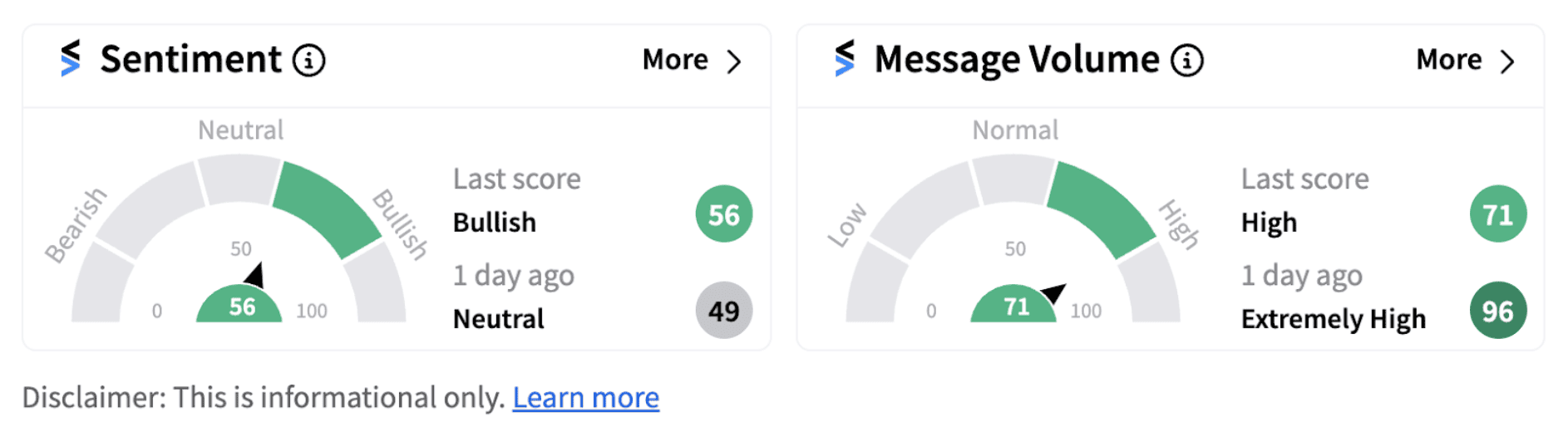

However, retail sentiment on Stocktwits inched-up into the bullish territory (56/100) from the ‘neutral’ zone on Thursday, accompanied by ‘high’ message volume.

Notably, Visa shares have delivered just over 5% gains since the beginning of the year, underperforming major benchmark indices. Stocktwits users with a bullish outlook believe the stock is an attractive buy at current levels.

https://stocktwits.com/taurus_bullish/message/587161273

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233437579_jpg_d27788b386.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_i_Phone_17_jpg_f5d6f375c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/02/JLR_jaguarlandrover.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_miguel_angel_sanz_Hp_Ypf5_Jy2_RU_unsplash_2ccae2426e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)