Advertisement|Remove ads.

Viking Therapeutics Stock Jumps After Q3 Earnings Beat: Retail Stays Cheerful

Shares of Viking Therapeutics, Inc. ($VKTX) surged over 5% pre-market on Thursday following a better-than-expected Q3 earnings report.

The biotech company posted a Q3 loss of $0.22 per share, beating analysts’ expectations of a $0.25 per share loss.

As of Sept. 30, Viking held $930 million in cash, cash equivalents, and short-term investments, a significant increase from the $376 million it had in the year-ago period.

CEO Brian Lian highlighted the productive period the company has experienced in 2024, with positive results from four different clinical trials and promising early findings from a new preclinical program.

Lian specifically emphasized the success of the Phase 2 VENTURE trial, which evaluated VK2735, a subcutaneous treatment for obesity, showing significant reductions in body weight after 13 weeks of treatment.

Additionally, a Phase 1 trial testing an oral formulation of VK2735 demonstrated similar positive outcomes, with excellent tolerability after 28 days. The trials also showed notable reductions in plasma levels of very long-chain fatty acids and other lipids.

Lian stated that with $930 million in financial resources, Viking is well-positioned to achieve important milestones with its clinical programs.

Investor attention on Viking Therapeutics has notably increased, especially since July, when the company announced plans to advance VK2735, which targets two gut hormones (GLP-1 and GIP), to Phase 3 trials.

This move brings Viking Therapeutics into competition with industry giants Novo Nordisk and Eli Lilly.

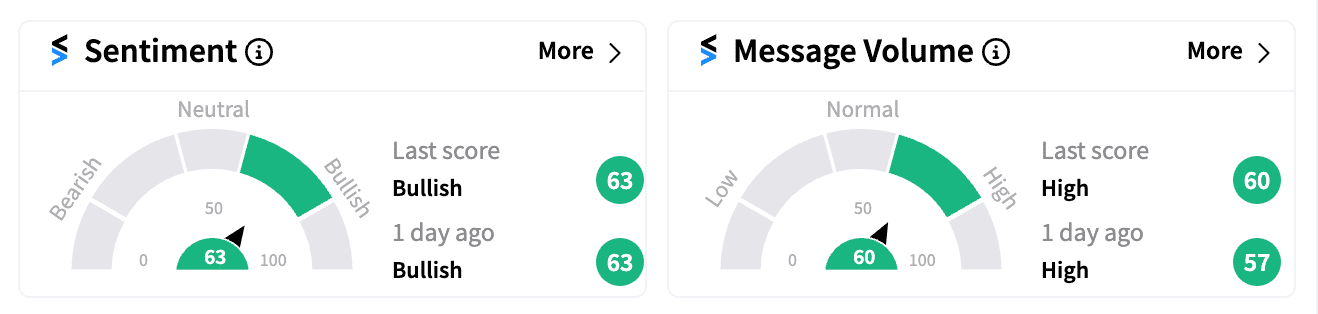

On Stocktwits, retail sentiment for VKTX was firmly in the ‘bullish’ zone ahead of Thursday’s opening bell, with message volume classified as ‘high’.

The company has experienced a surge in retail interest, with its following jumping by 38% over the past year, and Stocktwits chatter increasing by 1,170%.

Year-to-date, the stock has gained more than 230%, solidifying its position as one of the top performers in the biotech space.

William Blair analyst Andy Hsieh noted in July that the rapid development of VK2735 would find maximum value “in the hands of a big pharma” company, adding to speculation that Viking Therapeutics could be an acquisition target in the near future.

For updates and corrections email newsroom@stocktwits.com

Read next: Tesla Set To Snap 5-Day Losing Streak As Wall Street Lauds Q3 Earnings: Retail Mood Stays Down

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)