Advertisement|Remove ads.

Tesla Set To Snap 5-Day Losing Streak As Wall Street Lauds Q3 Earnings: Retail Mood Stays Down

Shares of Tesla, Inc. ($TSLA) surged over 13% pre-market on Thursday following a mostly positive quarterly earnings report, even as retail investors remained less enthusiastic.

If gains hold, the stock is on track to end its five-day losing streak, the longest since April this year.

Tesla broke two straight quarters of profit declines, with third-quarter adjusted earnings per share coming above estimates. Revenue climbed 8% year-over-year but came in slightly below expectations.

Key announcements during the post-earnings conference call included updates on Tesla’s plans to introduce more affordable models, which remain on track to start production in the first half of 2025.

Tesla also highlighted that its cost of goods sold per vehicle reached its lowest-ever level at $35,100.

Tesla CEO Elon Musk said that the Cybertruck has become the third-best-selling EV behind the Model Y and Model 3 during the quarter.

He also expressed confidence in reaching volume production of Tesla’s ride-hailing robotaxis by 2026 and expects the Cybercab to reach volume production in that same year.

Musk mentioned that Tesla is currently offering ride-hailing services to employees in the Bay Area and plans to roll out the service for the public in Texas and California by 2025.

On Wall Street, the reaction to Tesla’s results was overwhelmingly positive.

Wedbush Securities praised Tesla’s “Aaron Judge-like” margin performance, noting the 200bps beat on auto gross margin, which has been a concern in recent quarters. The firm maintained its ‘Outperform’ rating on the stock and kept its 12-month price target at $300.

Morgan Stanley called it “one of the strongest Tesla prints in a while,” with the potential for Q3 results marking a “bottom” in auto earnings expectations and sentiment. The firm maintained its ‘Overweight’ rating and raised its price target to $310.

There were some cautious voices from Wells Fargo, Goldman Sachs and Barclays, expressing concerns about price cuts, ability to meet ambitious delivery growth targets and sustain margins long-term.

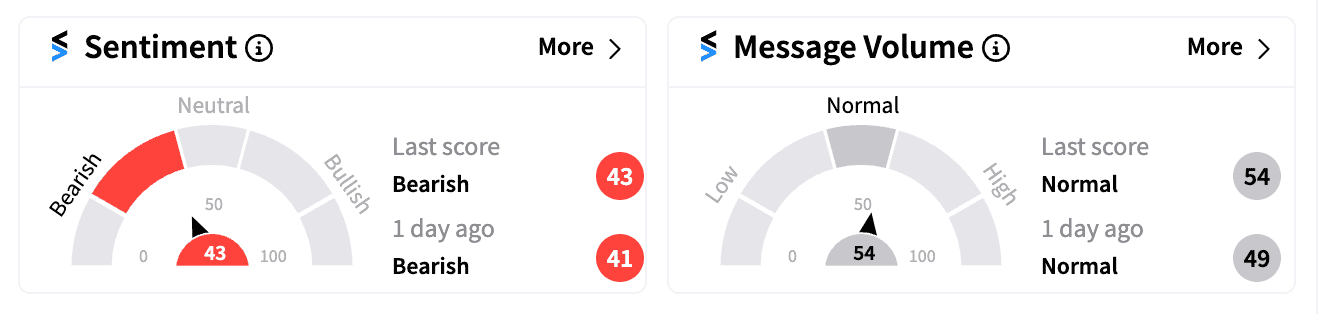

Still, retail sentiment among TSLA’s 972,000 followers on Stocktwits remained ‘bearish’ before the bell on Thursday.

Message volume surged by 233% ahead of the earnings release on Wednesday.

Several retail investors voiced concerns over Tesla’s revenue miss and slower-than-expected growth.

The stock is down 14.32% year-to-date, as of last close, and remains the worst performer among the ‘Magnificent 7’ tech stocks. It is on pace for its worst year since 2022, when it fell by 65%.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)