Advertisement|Remove ads.

Retail Turns ‘Extremely Bullish’ On Wall Street’s Top Gainer VOXX As Company Explores Potential Sale

Shares of VOXX International Corp. (VOXX) skyrocketed over 78% on Tuesday, making it the top gainer across U.S. markets, sparking a surge in retail sentiment.

The surge follows the automotive and consumer electronics company’s disclosure it is exploring strategic alternatives, including a potential sale, and that automotive tech firm Gentex Corp. had doubled its stake in VOXX.

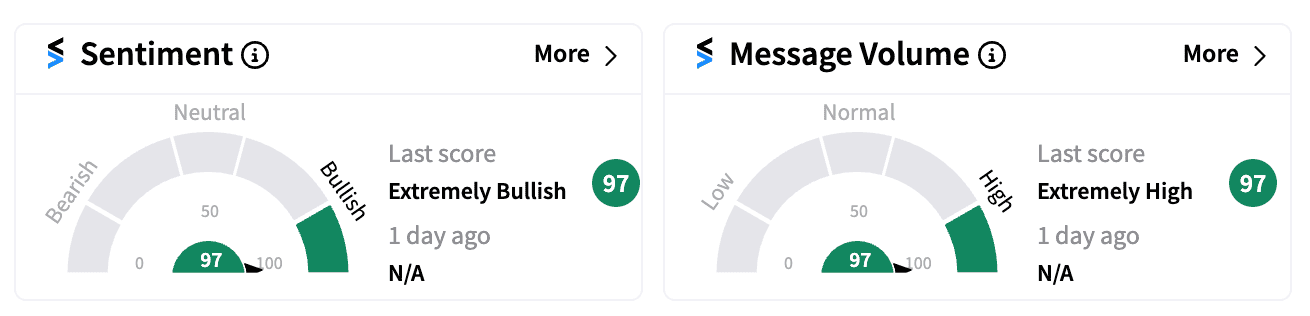

Retail sentiment on Stocktwits turned ‘extremely bullish’ (97/100) as message volume spiked to its highest in over a year.

VOXX said in a statement that its board is reviewing options to maximize shareholder value, ranging from operational improvements to a sale of segments or the entire company.

Gentex's increased stake, now nearly 32%, was acquired through the purchase of over 3.15 million shares at $5 each from VOXX’s vice chairman, Beat Kahli.

This move doubles Gentex's previous holding of roughly 16.4%. Notably, Gentex CEO Steve Downing already serves on VOXX's board.

Last month, VOXX reported disappointing June-quarter results, as sales of $91.66 million missed the $111.95 million Wall Street estimate, even as the loss per share was better than feared.

CEO Pat Lavelle had acknowledged the challenging retail environment, high interest rates, and ongoing inflation concerns, noting that the company has initiated restructuring programs aimed at returning to profitability this year.

Despite VOXX's recent rally, the stock is still down over 53% this year and hit a 52-week low of $2.27 last week.

The company cautioned that no timetable has been set for completing its strategic review and that there is no guarantee any transaction will occur.

Read Next: Netflix Stock Powers Past $700 Again, Retail Sentiment Hits 1-Year High

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)