Advertisement|Remove ads.

Netflix Stock Powers Past $700 Again, Retail Sentiment Hits 1-Year High

Shares of Netflix Inc. (NFLX) rose over 2% on Tuesday, reaching the $700 mark for the second time this year, lifting retail sentiment amid a bullish analyst outlook.

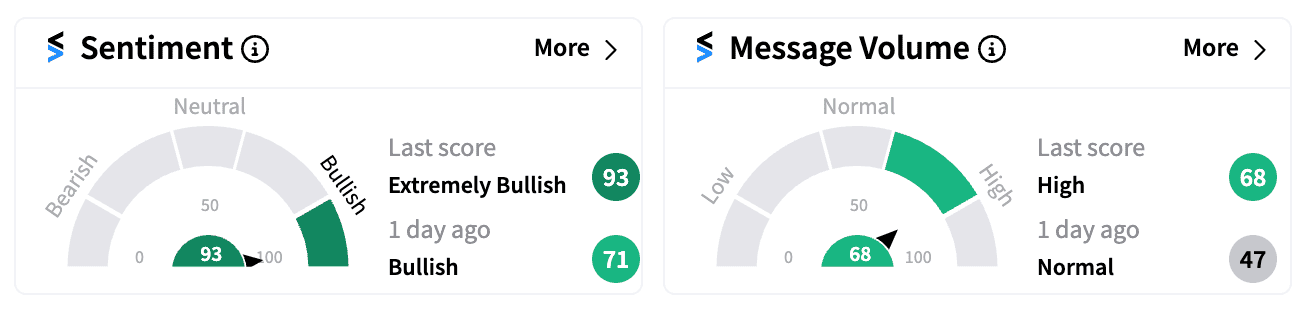

On Stocktwits, sentiment for NFLX surged to an ‘extremely bullish’ score (93/100), the highest in a year, accompanied by a spike in message volume.

Evercore ISI analyst Mark Mahaney on Tuesday raised Netflix’s price target to $750 from $710, maintaining an ‘Outperform’ rating. On Friday, the stock hit an all-time intraday high of nearly $711.

He cited recent survey data and channel checks, suggesting mid single-digit percentage upside to Wall Street’s FY25 EPS expectations, with further upside potential if Netflix resumes its historical price increase cadence.

Netflix's stock has gained over 50% this year, driven by a robust advertising strategy and high-profile partnerships with brands like LVMH and Google.

The company recently reported a 150% increase in upfront ad sales commitments compared to 2023.

Netflix’s plan to add live sports, including NFL games and WWE broadcasts this year has also attracted a broader audience and boosted its appeal to advertisers targeting live sports viewers.

That helped the company add 8.05 million customers in the second quarter.

As it pushes into ad-supported content, Netflix is also raising subscription prices, including a planned increase for its Standard plan this December.

A bullish retail investor on Stocktwits is now speculating that Netflix could breach the $1,000 mark, while another predicted a potential stock split.

Read Next: Sony Shares Climb As PlayStation 5 Price Hike In Japan Sparks Investor Optimism

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)