Advertisement|Remove ads.

Vroom Stock Plunges On Bankruptcy Plans, But Retail’s Bullish

Shares of automotive lender Vroom Inc. ($VRM) tumbled more than 21% (1:05 p.m. ET) on Wednesday after the company said it struck a debt exchange deal with its bondholders in a pre-packaged Chapter 11 case.

Vroom said it had entered an “equity-for-debt” recapitalization agreement that will restructure $290 million of its unsecured convertible notes in exchange for new shares of common stock. The deal positions the company for “long-term” growth, according to a company statement.

Existing holders of its common stock will get one share of new common stock plus a warrant to purchase a share of new common stock, Vroom said in the statement. These warrants will be exercisable for five years at a strike price of $12.19 per share.

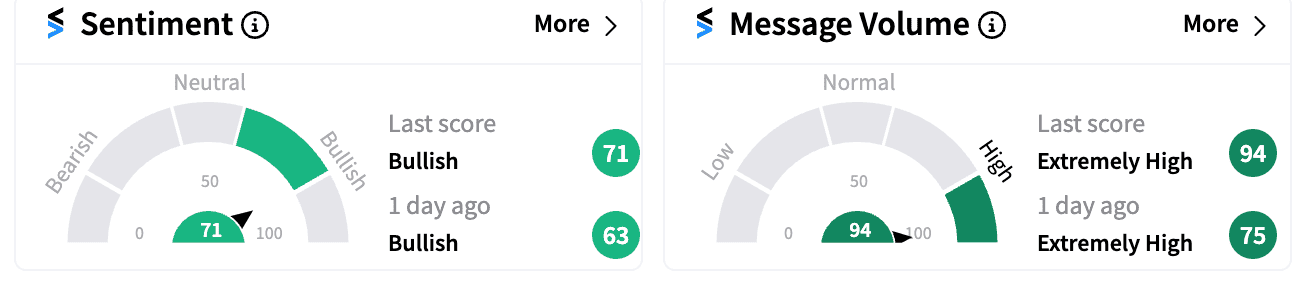

Retail sentiment on the stock inched up in the ‘bullish’ zone (71/100) from a day ago (63/100). Message volumes were at ‘extremely high’ levels.

Vroom owns and operates United Auto Credit Corporation, an indirect automotive lender, and CarStory, which provides AI-powered analytics and digital services for automotive retail.

For its third quarter, the company posted a net loss of $39.74 million compared to a net loss of $82.72 million in the year-ago quarter. As of Sept. 30, the company had $51.1 million in cash and cash equivalents, according to its statement.

“We believe eliminating our unsecured notes will significantly strengthen our balance sheet and allow us to emerge without any long-term debt at Vroom Inc., while its subsidiary, UACC, will continue to be obligated to debt that is related to asset-backed securitizations and their trust preferred securities,” Tom Shortt, Vroom CEO, said in a statement.

He added the company is focused on executing its long-term strategy and is making progress on key initiatives and portfolio performance.

Earlier this year, Vroom said it would discontinue its e-commerce operations and wind down its used vehicle dealership business to preserve liquidity and help maximize stakeholder value.

Reaction to the move was mixed among Stocktwits users, with some commenters feeling bullish about the direction of the company.

Vroom stock is down 85% year-to-date.

For updates and comments, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)