Advertisement|Remove ads.

VivoPower Stock Surges On Moving Ahead With $200M Tembo Deal With Energi: Retail Remains Bullish

Shares of VivoPower International closed 20.5% higher at $5.17 on Tuesday after Energi Holdings completed the second phase of due diligence for its proposed $200 million acquisition of a stake in the sustainable energy solutions company’s electric vehicle unit.

Both sides now plan to finalize the transaction structure and aim for a swift closing, Vivo Power said in a statement on Tuesday.

Energi, based in Abu Dhabi, is a $1 billion-a-year energy company with operations across several continents.

Tembo will continue its merger with Cactus Acquisition Corp. (CCTS) and pursue a separate public listing as part of the plan.

VivoPower's board is also considering how best to use the deal's proceeds, including the possibility of returning capital to shareholders or issuing a special dividend.

Last week, VivoPower received Energi's revised proposal for a majority stake in Tembo. The proposal valued the unit by $20 million more than a prior offer and proposed the acquisition of a 51% stake instead of gaining 80% of non-affiliated shares of VivoPower.

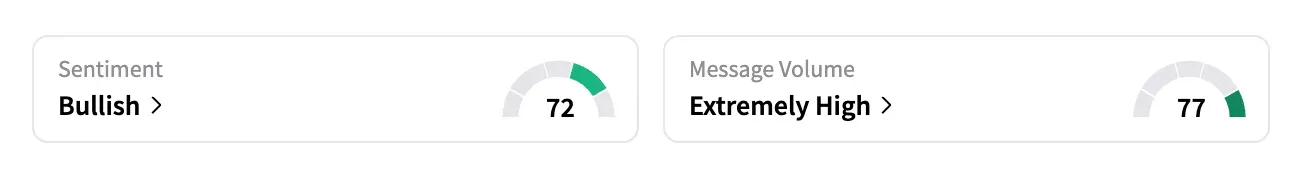

Retail sentiment on Stocktwits around VivoPower ended on a ‘bullish’ note on Tuesday, amid an 11% jump in 24-hour message volume.

One user believes that the sentiment around the revised proposal could take the stock price to double figures.

Adding to the buzz was VivoPower’s announcement on Monday that it would partner with digital asset infrastructure provider BitGo to acquire XRP cryptocurrency tokens.

VivoPower will use BitGo’s over-the-counter (OTC) trading desk to acquire $100 million worth of XRP tokens.

The company will also use BitGo to trade its XRP holdings and store its assets. It has secured $121 million in funding to support its strategic shift toward an XRP-focused treasury and decentralized finance solutions business.

Some Stocktwits users expressed pessimism about VivoPower’s crypto pivot, with one calling it a “scam stock.”

VivoPower’s stock has surged 288.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)