Advertisement|Remove ads.

VVPR Stock Surges 18% Today – What Is The South Korean JV Deal About?

- The investment vehicle will target $300 million in Ripple Labs shares.

- The JV will give exposure to Ripple Labs’ future upside without using capital from its own balance sheet.

- This comes after VVPR struck a deal last month with KWeather to create a weather-based digital token.

VivoPower International (VVPR) stock surged 18% in premarket trading on Friday after its digital asset unit, Vivo Federation, entered a joint venture with Seoul-based asset manager Lean Ventures to create an investment vehicle targeting $300 million in Ripple Labs shares.

Vivo Federation will source Ripple Labs shares for the vehicle and has secured approval to purchase an initial tranche, while negotiating further acquisitions from institutional holders. The joint venture is expected to generate about $75 million in net returns for VivoPower over three years, giving the company exposure to Ripple Labs’ future upside without deploying capital from its own balance sheet.

"As we have noted previously, South Korea is a highly strategic market for Vivo Federation, given that it is the largest holder by value and number of XRP tokens in the world. With this dedicated investment vehicle, qualifying South Korean institutional and retail investors can gain exposure to Ripple Labs shares and, in turn, XRP at a material discount to the spot price," said Adam Traidman, Chairman of VivoPower’s Advisory Council.

South Korean Partnership Momentum

Last month, the company announced a deal with South Korea’s largest weather firm, KWeather, to create a weather-based digital token.

VivoPower will invest $5 million for a 20% stake in KWeather and secure two of the company’s five board seats. The partners plan to use the funds to develop WeatherCoin, a climate-risk digital derivative, while KWeather also intends to buy VivoPower shares and gain access to XRP and other potential Ripple-related investments.

How Did Stocktwits Users React?

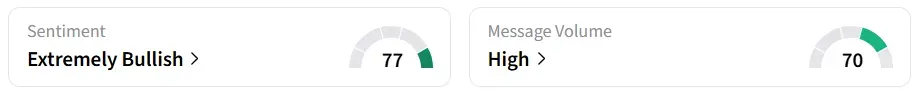

Retail sentiment on Stocktwits turned 'extremely bullish' from 'neutral' a day earlier, amid 'high' message volumes.

One user saw the deal as a huge boost for the company.

Year-to-date, the stock has gained 123%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)