Advertisement|Remove ads.

Wall Street Divided On AT&T Stock, But Retail Braces For Rally Following Q1 Print

Two analysts gave AT&T, Inc. (T) mixed reviews on Monday, but retail traders are unanimously bullish on the stock.

While Raymond James analysts upped the price target for AT&T stock, Citi removed it from its “Focus List,” TheFly reported.

Raymond James analyst Frank Louthan maintained a ‘Strong Buy’ rating on AT&T stock, but he raised the price target to $30 from $29. The analyst said he expects the company to continue to drive value for investors with stock appreciation

Louthan expects wireless growth and a free cash flow ramp to bring investors to the name.

Raymond James named AT&T its best “large-cap” return story over the next 12 months.

On the other hand, Citi’s decision to yank the stock off the “Focus List” is due to its recent outperformance vis-a-vis the broader market. According to the analyst, AT&T’s improved fundamental outlook is now partly reflected in the stock’s current valuation.

However, the brokerage said AT&T remained its overall top pick due to its belief that the company can sustain a balanced approach between price and volume for its strategic products to deliver on its financial growth targets.

Citi has a ‘Buy’ rating and a $32 price target for the stock.

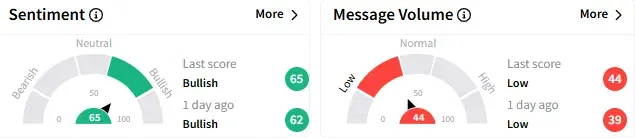

On Stocktwits, retail sentiment toward the stock remained ‘bullish’ (65/100), but the message volume stayed ‘low.’

A bullish user expects the upcoming earnings report to catalyze a stock price move to $30. They also braced for a stock buyback from the company.

AT&T is scheduled to report its first-quarter results before the market opens on April 23.

Another user said the stock could see a reversal of the recent negative sentiment once the market stabilizes.

Despite Friday’s pullback amid the market-wide weakness set in motion by the tariff uncertainty, AT&T is the ninth best-performing stock this year.

The stock has gained over 18% so far this year. By the mid-session on Monday, the stock was up about 0.40% at $26.74.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Palantir Stock Rises Defying Market Downturn: Retail Shrugs Off Upside As ‘Dead-Cat Bounce’

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)