Advertisement|Remove ads.

Wall Street Titans Sound Alarm: Goldman Sachs, Morgan Stanley Reportedly Expect 10%-20% Market Correction

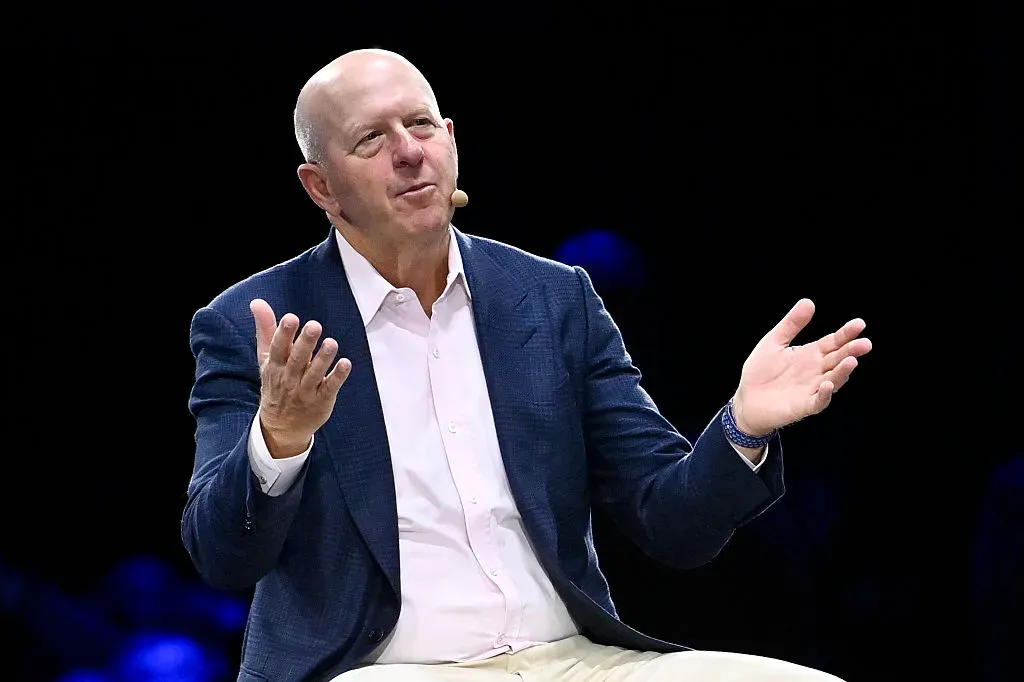

- Goldman Sachs CEO David Solomon told investors that markets may face a pullback of between 10% and 20%.

- Morgan Stanley CEO Ted Pick echoed Solomon’s outlook, calling short-term corrections “healthy”.

- The S&P 500 and Nasdaq Composite recently touched new peaks.

Global markets could reportedly be heading toward a pause after a record-breaking rally in 2025, warned top Wall Street executives at Goldman Sachs Group Inc. (GS) and Morgan Stanley (MS).

Both firms cautioned that the next two years may bring a market correction, even as stocks worldwide hover near record highs.

Possible Market Drawdown

According to a CNBC report, the S&P 500 and Nasdaq Composite recently reached new peaks, while the Shanghai Composite hit its strongest level in a decade, amid improving U.S.-China relations and a weaker dollar.

Goldman Sachs CEO David Solomon told investors at the Global Financial Leaders’ Investment Summit in Hong Kong that markets may face a pullback of between 10% and 20% within the next one to two years.

“Things run, and then they pull back so people can reassess.”

-David Solomon, CEO, Goldman Sachs.

However, he emphasized that drawdowns of 10% to 15% are common and should not shake long-term confidence in equity investing. Morgan Stanley CEO Ted Pick echoed Solomon’s outlook, calling short-term corrections “healthy” and a sign of a functioning market rather than the beginning of a tough time.

Tech Earnings, U.S. China Truce Push Markets

Earnings from five of the “Magnificent Seven” tech giants, Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), and Meta (META), provided a push to markets on optimism surrounding their involvement in artificial intelligence projects.

Additionally, the recent meeting between U.S. President Donald Trump and his Chinese counterpart, Xi Jinping, to decide on a framework that could pause tougher U.S. tariffs and China's rare-earth export curbs eased market uncertainties.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)