Advertisement|Remove ads.

Rare Earth Stocks In Spotlight After Trump-Xi Agree To Critical Minerals Deal

- China dominates over 90% of refined rare earth, which are used in a wide range of applications, ranging from semiconductors to missile defense systems.

- According to Trump, Beijing will enter into a one-year agreement each year for rare-earth exports.

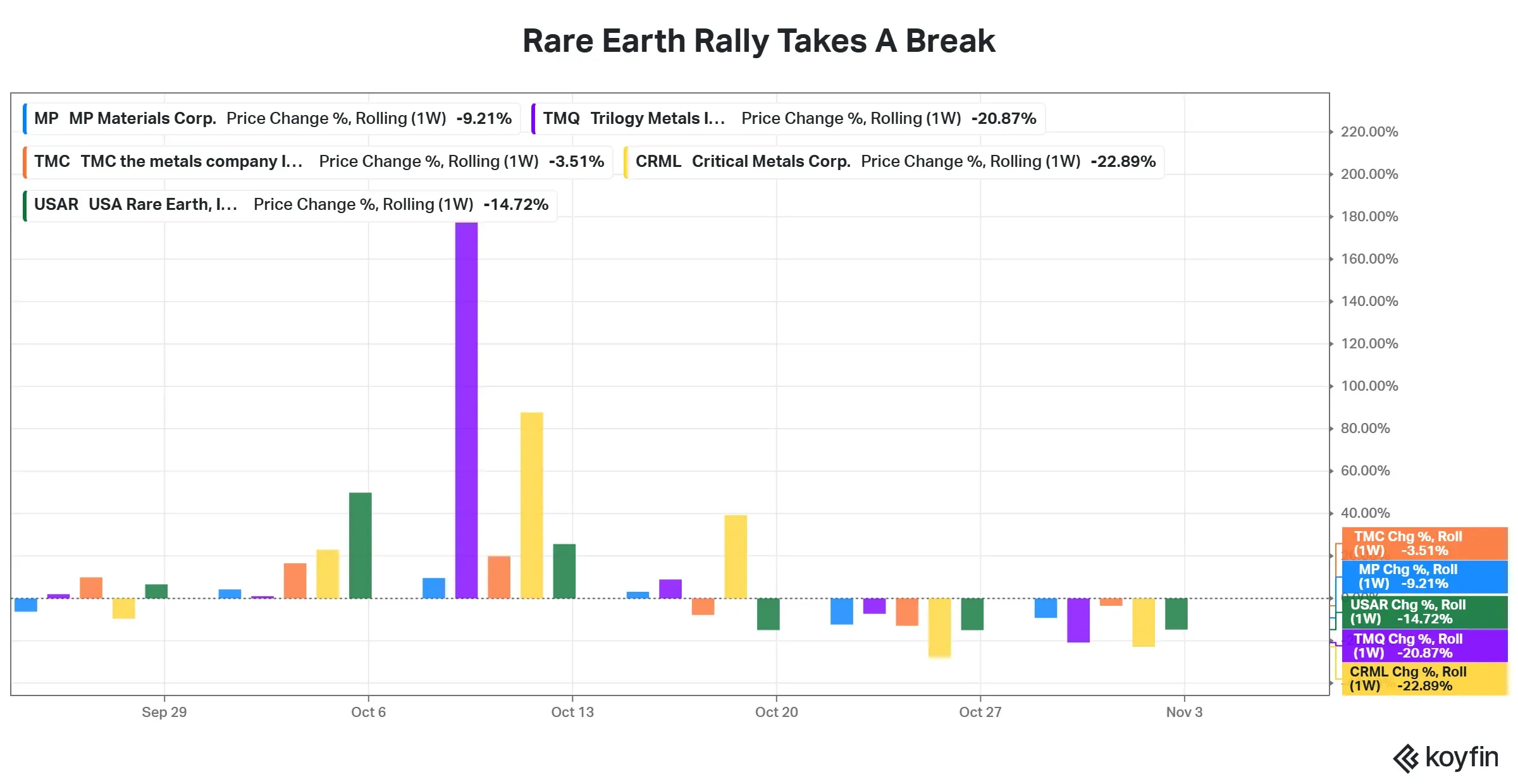

- MP Materials' stock is down 9.2% this week. The Metals Company stock has fallen 3.5%, Critical Metals stock slipped 8.5%, USA Rare Earth, and Trilogy Metals have fallen between 14.7% and 22.9%.

Rare earth stocks were in focus on Thursday after U.S. President Donald Trump and Chinese President Xi Jinping struck several agreements, including one on critical minerals, to ease supply concerns.

As per Trump, Beijing will create a one-year agreement each year for rare earth exports to be renegotiated during the time of renewal, and "work very hard to stop fentanyl," a synthetic opioid used medically for severe pain relief, but is also illegally produced and sold. At the same time, tariffs on Chinese exports will also be lowered to 47% from 57%.

Rare Earth Stocks In The Red For The Second Week Running

MP Materials' stock is down 9.2% this week. The Metals Company stock has fallen 3.5%, Critical Metals stock slipped 8.5%, USA Rare Earth, and Trilogy Metals have fallen between 14.7% and 22.9%. Rare earths were part of a broader framework agreement between the two sides on the sidelines of an Association of Southeast Asian Nations meeting in Kuala Lumpur, Malaysia.

China dominates over 90% of refined rare earth, which are used in a wide range of applications, ranging from semiconductors to missile defense systems. The latest dispute between the two countries began after China imposed export curbs on rare earths, especially to chipmakers and defense firms.

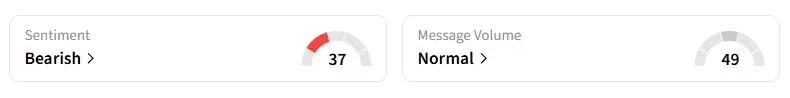

Retail sentiment on Stocktwits about MP Materials, the top domestic producer, was in the ‘bearish’ territory at the time of writing.

“Regardless of a China-USA deal. We need MP to continue to advance production. We can't be held hostage in the future for rare earths. We need our own production,” one user wrote.

“A kind of gallows deadline for the U.S., which must be renegotiated every year, and puts additional pressure on the U.S.,” said another trader.

Why Are Rare Earth Stocks Up This Year?

The White House has stepped up its efforts over the past months to increase domestic production of critical minerals. The U.S. has taken stakes in companies such as Lithium Americas, MP Materials, Critical Metals, and Trilogy Metals. The White House has also stated that it is in talks with many other companies over potential stakes.

MP Materials and Trilogy Metals stocks have more than quadrupled this year. Critical Metals stock and USA Rare Earth stock have gained nearly 72% and 45%, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)