Advertisement|Remove ads.

Big Short 2.0? Michael Burry Bets Against Nvidia, Palantir Stocks In Stark Warning Against AI Euphoria: ‘Move Along’

- Scion Asset Management’s 13F filing showed Michel Burry’s disdain for tech names trading at staggering valuations.

- The filing also showed new positions in Halliburton, Molina, and SLM.

- Burry shot to fame by accurately predicting the housing market crash of 2008.

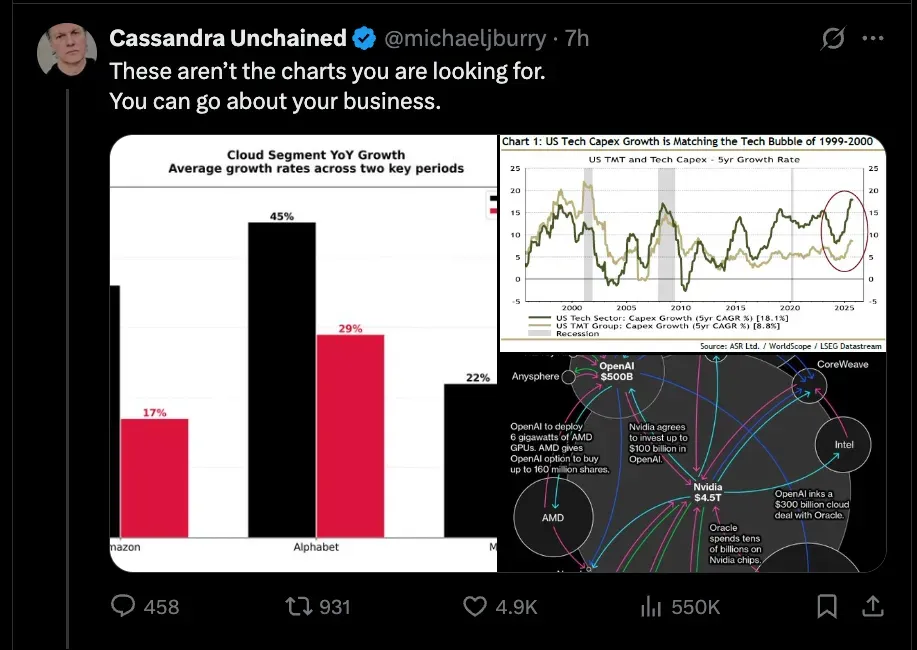

After warning last Thursday not to play market “bubbles,” prominent hedge fund manager Michael Burry shared a few charts to prove his point that a froth is building in the tech sector. Separately, the 13F filing by Burry’s hedge fund, Scion Asset Management, showed that the bulk of his portfolio comprised short bets on two prominent tech companies with exposure to artificial intelligence — Nvidia and Palantir.

The post shared on Thursday marked his first since April 2023.

Nvidia, the artificial intelligence (AI) chip powerhouse, and AI-powered data analytics provider Palantir, which reported stellar quarterly results Monday, have seen their shares surge, riding on the momentum. For the year-to-date period, Nvidia stock has gained 54%, helping the company top the $5 trillion market capitalization mark, while Palantir stock is up nearly 175%.

On Stocktwits, retail sentiment toward Nvidia tempered to ‘bullish’ by early Tuesday from ‘extremely bullish’ a day before. The 24-hour message volume on the stream also reduced, but was at ‘high’ levels. On the other hand, retail sentiment toward Palantir stock remained ‘extremely bullish’ as of early Tuesday, with the chatter perking up to ‘extremely high’ levels.

Burry Says ‘Move Along’

Burry, who shot to fame by accurately predicting the 2008 housing market crash, shared a chart showing slowing cloud revenue growth at the cloud businesses of the big three cloud vendors. Another chart showed the widening gap between tech capital spending growth and the combined spending growth for the tech, media, and telecommunications (TMT) sector.

He also highlighted circular deals going around in the artificial intelligence (AI) space, which have already raised concerns among market participants. As recently as this week, Amazon announced a multi-year strategic partnership with OpenAI, valued at $38 billion, which allows the Sam Altman-led AI startup to use its EC2 UltraServers to run and scale its AI workloads. In recent weeks, we have seen Nvidia strike a slew of supply deals with AI infrastructure companies, both big and small, and also invest in these companies.

Captioning the post on X, Burry said, “These aren’t the charts you are looking for. You can go about your business.”

Burry found an ally in a former JPMorgan and BofA strategist, Marko Kolanovic, who replied to his post: “I agree with Michael Burry. Everyone important involved in this network, and to various degree dishonest. “They have to play along until the party stops (some, not literal, similarities to Epstein network).”

Additionally, Burry shared a June 2002 Fortune article that highlighted the telecom sector's plight in the early 2000s, when demand faltered, pushing prices down and forcing some companies valued at hefty premiums to seek protection from creditors. “Move along,” he said.

What Burry’s Hedge Fund Holdings Reveal

The 13F report filed by Scion late Monday showed that by the end of the third quarter, he held put options worth $912.10 million in Palantir and $186.58 million in Nvidia, compared to no positions in either in the previous quarter. In terms of the value of holdings, the short bets accounted for roughly 80% of the total.

Burry’s hedge fund sold the buy options he held in Chinese stocks Alibaba (BABA) and JD.com (JD), as well as in Dutch chipmaker ASML (ASML), Meta Platforms (META), V.F. Corp. (VFC), and personal care products company Estee Lauder (EL). The firm also sold shares and call options in Regeneron (REGN) and the struggling healthcare giant UnitedHealth (UNH), as well as shares of MercadoLibre, Inc. (MELI).

Scion, however, doubled down on its holding of retailer Lululemon Athletica (LULU) but sold the call options to buy shares. It added bullish call options on Halliburton (HAL). The firm purchased shares of Molina Healthcare (MOH) and SLM Corp. (SLM), a student loan services company, as well as call options in Pfizer (PFE).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why Navitas Stock Plunged Over 14% In After-Hours Trading

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)