Advertisement|Remove ads.

Warren Buffett Unloads Bank of America: How Retail Investors Reacted

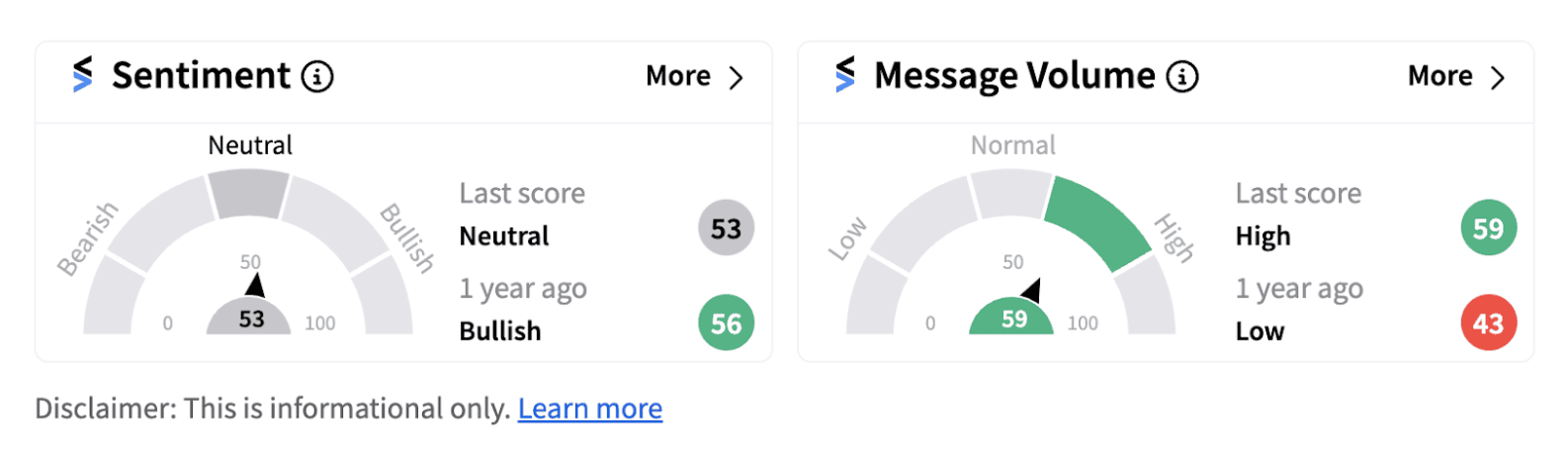

Legendary investor Warren Buffett-owned Berkshire Hathaway has trimmed its stake in Bank of America for the first time since 2019 over six trading sessions. Despite the stake reduction, retail investors have refrained from turning bearish on the stock with the sentiment meter trending in the neutral zone (53/100) supported by high message volume.

The sale of shares took place from Wednesday July 17 through July 24, according to filings on the Securities and Exchange Commission (SEC) website. Last week, Berkshire sold roughly 33.89 million shares of the lender at prices ranging from $43.13 to $44.07. This week, the firm sold another 18.89 million shares at prices ranging from $42.39 to $42.56.

In total, Berkshire sold 52.89 million shares of the lender in six sessions that amounts to approximately $2.30 billion worth of stock. However, Berkshire still holds over 980 million shares of the bank, worth $41 billion at current prices. That’s second only to its stake in Apple which is worth a whopping $172 billion.

Notably, the share sale comes in the wake of a decent rally registered by Bank of America stock this year, having gained over 23% on a year-to-date (YTD) basis. The lender, too, has been doing well on its operational metrics. Last week, it announced an upbeat set of earnings that topped analyst estimates on multiple counts. The bank reported a revenue of $25.40 billion during the quarter which came in higher than a Street estimate of $25.22 billion. Earnings per share came in at 83 cents as compared to an estimate of 80 cents.

But that’s not all. The bank has been in the news lately after it increased its common stock dividend by 8% to $0.26 per share. The Board also authorized a new $25 billion common stock repurchase program, effective August 1, 2024, to replace the company’s current program, which will expire on that date.

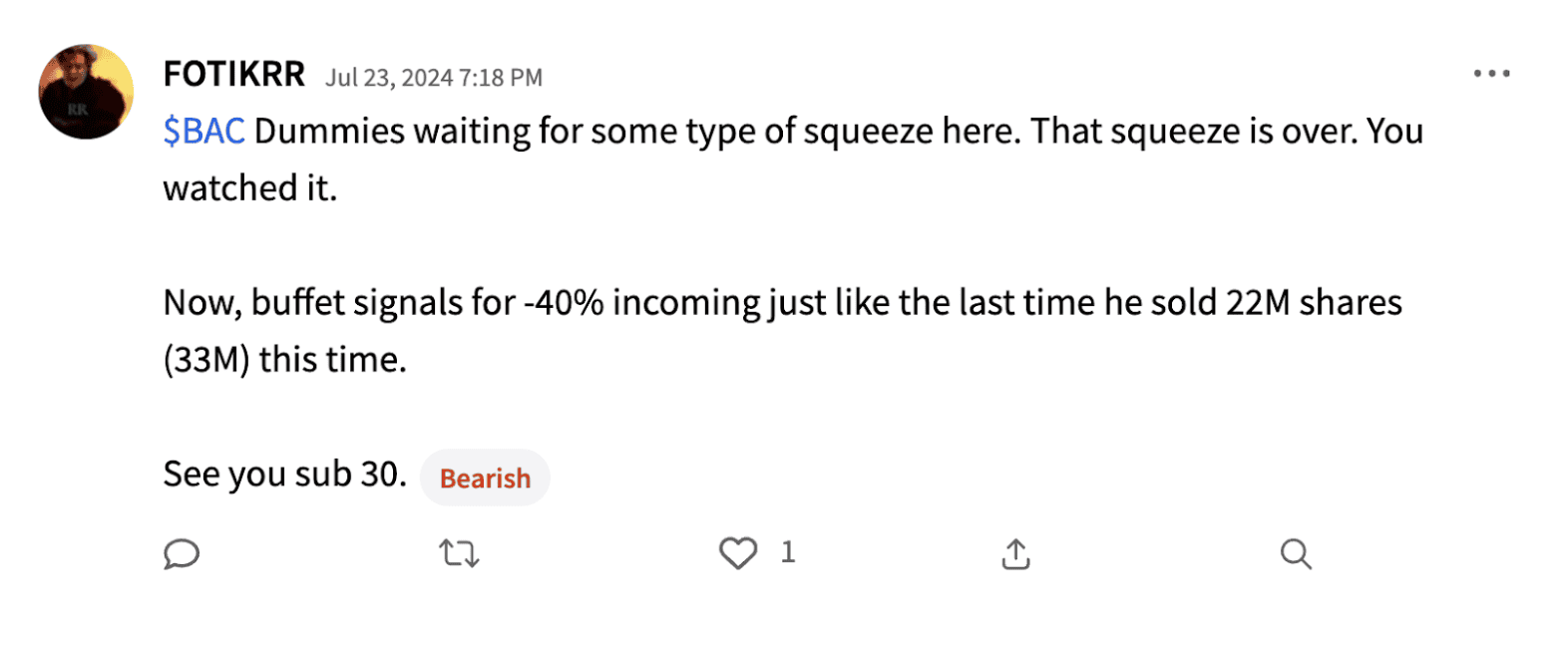

Stocktwits users are chatting about the buyback and the dividend hike, but some aren’t optimistic about the stock post Berkshire’s selling. A user named ‘FOTIKRR’ believes the stock could fall below the $30 mark and Buffett’s stake reduction in the lender is a precursor for a downward move in the stock and the broader financial sector.

Photo Courtesy: Bank of America website

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)