Advertisement|Remove ads.

Alto Neuroscience Is Down Nearly 35% This Year, But Retail Traders Keep Flocking To Micro-Cap Stock

Alto Neuroscience Inc. has struggled recently, with shares losing more than 12% over the past week, extending a decline that began in late October following disappointing Phase 2 results for its major depressive disorder (MDD) treatment, ALTO-100.

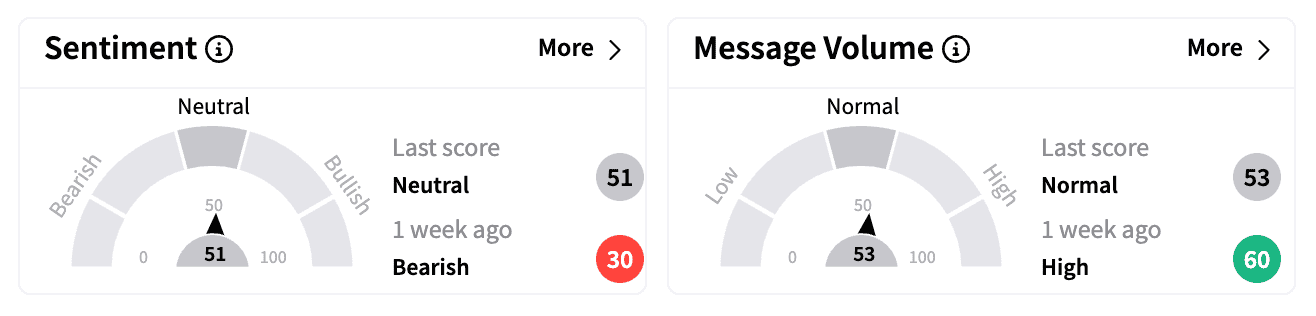

Despite the stock sliding over 34% this year, it has not lost appeal among retail traders as Alto's follower count on Stocktwits has surged 44.6% in the past week.

Over the last year, its retail following on the platform has grown by an astonishing 876%, suggesting that traders remain interested in the company's long-term prospects.

Alto is developing treatments for central nervous system diseases and has positioned its biomarker-driven approach as a differentiator in psychiatric drug development.

While ALTO-100's Phase 2 results failed to meet expectations, the company has emphasized the potential of ALTO-300, another MDD treatment currently in Phase 2b trials.

Last month, Alto announced that a planned interim analysis of the trial had a favorable outcome, prompting the company to expand the study by approximately 50 biomarker-positive patients. Topline results from the trial are expected in mid-2026.

The company also secured a U.S. patent for ALTO-300, covering its use as an adjunctive treatment for MDD patients who have not responded adequately to traditional antidepressants.

The patent also includes methods for identifying eligible patients using EEG-based biomarker selection, which Alto sees as a key advantage in developing more targeted psychiatric treatments.

Retail traders on Stocktwits have pointed to several potential catalysts, including reports that Jefferies sees a 500% upside for the stock.

Some investors have also highlighted Alto's financial position, noting that the company is trading near 40% of its cash value while holding two Phase 3-ready assets and no debt.

Jones Research maintained a 'Buy' rating with an $18 price target in December, arguing that the market reaction to ALTO-100's failure was overdone.

Last week, Alto said it would participate in a series of upcoming industry conferences in March, including the TD Cowen 45th Annual Health Care Conference, Leerink's Global Healthcare Conference, and the Stifel 2025 Virtual CNS Forum.

With attention now focused on the ALTO-300 trial and upcoming investor events, retail investors will be hoping market sentiment around the stock tilts back into the bullish zone.

Alto stock is rated ‘buy’ among six out of seven analysts covering the stock on Wall Street, with one rating ‘hold’, according to Koyfin data.

Short interest, meanwhile, has edged down from 15.1% at the start of this year to 14.7% as of the end of last week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)