Advertisement|Remove ads.

WeightWatchers Bankruptcy Buzz Could Be A Strategy To 'Get A Better Deal With The Bonds,' Says Activist Investor

WW International Inc. (WW) investor Galloway Capital Partners has reportedly said that market chatter around the weight loss company's bankruptcy could be part of the company's debt-negotiation strategy.

"This could be a negotiating tactic to get a better deal with the bonds," Chief Investment Officer Bruce Galloway said in an interview with MarketWatch.

Earlier this month, reports emerged that WW, popularly known by the name of its wellness clinic WeightWatchers, was considering filing for Chapter 11.

Galloway Capital put out a note last week urging the company against that move and disclosed a 2.87% stake in the firm.

The activist investor wrote that the possible bankruptcy plan "would make little sense" given that the debt is not due to mature until 2028 and 2029.

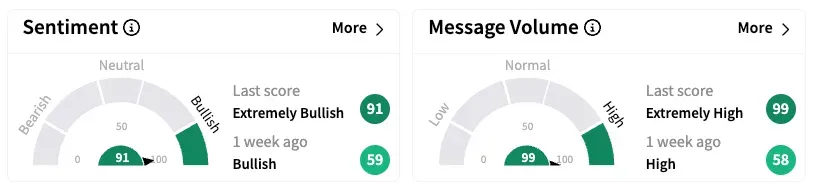

On Stocktwits, retail sentiment climbed to 'extremely bullish' from 'bullish' a week ago.

User posts suggested a positive positioning on the stocks, and some noted the growing chatter on the social media platform Reddit.

WeightWatchers helps users lose weight and build healthy habits through subscription-based programs that offer meal plans, tracking tools, coaching, and community support.

In recent years, the business has struggled partly due to the rise of weight-loss drugs like Novo Nordisk’s Ozempic and Eli Lilly’s Zepbound. The company's revenue has fallen 11% to 14% in each of the last three years.

It also has taken on significant debt, and repayment is due in the coming years.

In February, credit ratings firm S&P Global Ratings downgraded WW International, saying that its subscriber base has aged, and its brand is out of favor.

WeightWatchers shares skyrocketed 168% on Friday after Galloway Capital's note. They are down 67% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)