Advertisement|Remove ads.

Wells Fargo Generates Retail Buzz After $40B Share Buyback Plan

Wells Fargo (WFC) stock gained 2.4% on Tuesday after the company unveiled a new share buyback plan worth $40 billion.

The lender said the new stock repurchase program would take effect after its current plan expires.

Wells Fargo’s previous share buyback program, worth $30 billion, was launched two and a half years ago.

“We have been investing to drive more organic growth and improve the earnings capacity in each of our businesses, which allows us to maintain a competitive, sustainable dividend and return excess capital to our shareholders through repurchases,” Chief Executive Officer Charlie Scharf said in the statement.

The bank repurchased $3.5 billion of stock in the first quarter, or approximately 1.75% of its outstanding shares.

Wells Fargo is also trying to lift a $1.95 trillion asset cap imposed on the bank by the Federal Reserve in 2018 due to its compliance issues.

On Monday, it closed the twelfth consent order since 2019.

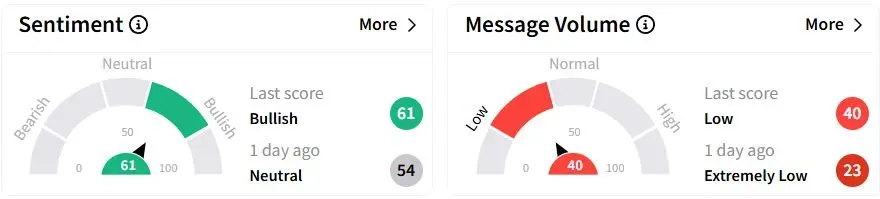

Retail sentiment on Stocktwits moved to ‘bullish’ (61/100) territory from ‘neutral’ (54/100) a day ago, while retail message volume increased by 100%.

One retail trader suggested it would be crazy not to look at Wells Fargo as a long-term bet.

The bank reported mixed first-quarter results as its earnings topped estimates while revenue fell short of expectations.

Wells Fargo stock has gained marginally year to date (YTD).

Also See: Trump Says China 'Will Probably Eat Those Tariffs' To Cushion The Blow On US Consumers

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)