Advertisement|Remove ads.

Welltower Bets Big On Senior Housing With $3.2B Deal In Canada: Retail Stays Unmoved For Now

Welltower (WELL) stock will likely attract retail attention on Monday after it agreed to buy luxury senior housing provider Amica Senior Lifestyles’ portfolio and certain assets from the Ontario Teachers’ Pension Plan Board for C$4.6 billion ($3.2 billion).

The real estate investment trust (REIT) would gain 31 in-place properties, comprising 24 stabilized communities and seven recently opened properties still in lease-up.

The portfolio is located within the Canadian cities of Toronto, Vancouver, and Victoria. Welltower said it is acquiring the in-place properties at a substantial discount to the estimated replacement cost.

The company said that the Amica assets have exhibited ‘significant pricing power’ with revenue per occupied room (RevPOR) growth, outperforming Welltower's overall senior residences portfolio over the past five years.

“Against a backdrop of rapidly growing demand and limited new supply, we expect the portfolio to drive outsized revenue and cash flow growth in the coming years," CEO Shankh Mitra said.

In addition to the 31 properties, Welltower would also buy seven properties currently under construction after achieving certificates of occupancy, which is expected to occur in stages between 2025 and 2027.

The deal, including nine land parcels in affluent neighborhoods, is expected to close in the fourth quarter.

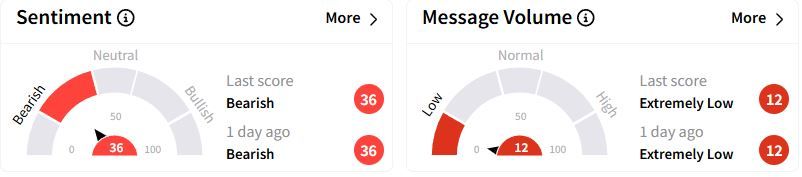

Retail sentiment on Stocktwits stayed in the ‘bearish’ (36/100) territory, while retail chatter was ‘extremely low.’

In January, Welltower agreed to buy NorthStar Healthcare Income, an owner of senior housing properties, in a deal valued at $900 million.

The company had forecasted normalized funds from operations (FFO) between $4.79 and $4.95 per share in 2025, aided by strong growth in senior housing net operating income.

Over the past year, Welltower stock has gained nearly 67%.

1 Canadian dollar (C$) = $0.69

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)