Advertisement|Remove ads.

Welspun Enterprises shares jump 8%; Board approves convertible warrants issue worth ₹1,000 crore

The funds will be raised via a preferential issue on a private placement basis, with each warrant priced at ₹525.

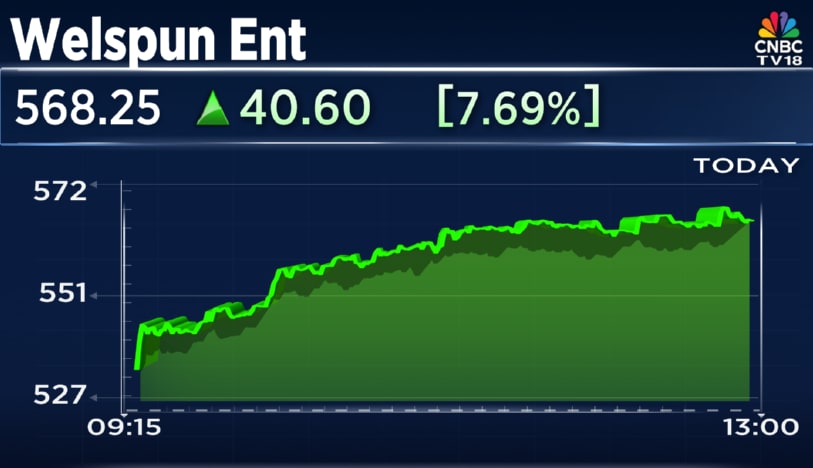

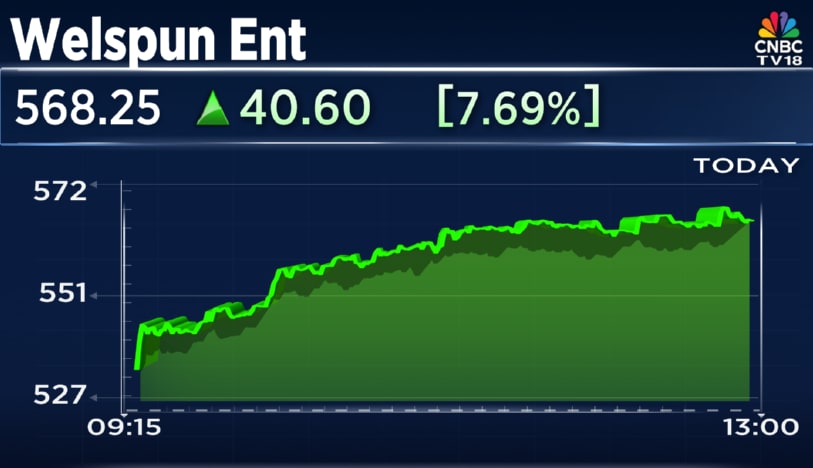

Shares of Welspun Enterprises Ltd. gained as much as 10% on Wednesday, October 15, after the company approved a proposal to raise up to ₹1,000 crore through the issuance of convertible warrants.

The funds will be raised via a preferential issue on a private placement basis, with each warrant priced at ₹525.

In the last quarter, the company reported consolidated net profit of 30% year-on-year to ₹100.3 crore.

Revenue rose 24% YoY to ₹1,021.5 crore, compared to ₹823 crore in the corresponding quarter last year.

EBITDA surged 35% to ₹152.62 crore, while operating margins improved to 14.94% from 13.74% a year ago.

The company had seen a rise in finance costs, which stood at ₹43.6 crore in Q4FY25 versus ₹28.4 crore in the year-ago quarter.

At present, Welspun Enterprises shares are trading 6% higher at ₹559.45. The stock has declined 7% so far in 2025.

The funds will be raised via a preferential issue on a private placement basis, with each warrant priced at ₹525.

In the last quarter, the company reported consolidated net profit of 30% year-on-year to ₹100.3 crore.

Revenue rose 24% YoY to ₹1,021.5 crore, compared to ₹823 crore in the corresponding quarter last year.

EBITDA surged 35% to ₹152.62 crore, while operating margins improved to 14.94% from 13.74% a year ago.

The company had seen a rise in finance costs, which stood at ₹43.6 crore in Q4FY25 versus ₹28.4 crore in the year-ago quarter.

At present, Welspun Enterprises shares are trading 6% higher at ₹559.45. The stock has declined 7% so far in 2025.

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/BLK_June_5_jpg_bb0a1e439c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215606078_jpg_d962cbd2e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_resized_jpg_021f4f34df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/09/heritage-foods-2024-09-d900579319eb8fc2a86ca18c04b0d796.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/paytm_resized_jpg_b93a10a534.webp)