Advertisement|Remove ads.

Wendy’s Interim CEO Projects International Net Unit Growth Of Over 9%: ‘Momentum Continues To Build’

- Cook said Wendy’s global strategy is centered on offering “globally great, locally even better” experiences.

- The company reported a Q3 revenue of $549.5 million and an adjusted earnings per share (EPS) of $0.25.

- International systemwide sales increased 8.6% year-on-year.

Wendy’s Co. (WEN) interim Chief Executive Officer Ken Cook on Friday highlighted the company’s continued strength in its international business, robust customer demand, and growth momentum across key markets.

“Momentum continues to build across our markets, and we expect international net unit growth of over 9% in 2025.”

- Ken Cook, Interim CEO and CFO, Wendy’s

Strong international performance

During the third-quarter (Q3) earnings call, Cook stated that Wendy’s global strategy, centered on offering “globally great, locally even better” experiences, continues to resonate strongly with consumers worldwide.

Cook said the fast-food chain’s overseas operations posted another quarter of solid systemwide sales growth in Q3, driven by higher same-restaurant sales and a steady pace of new store openings.

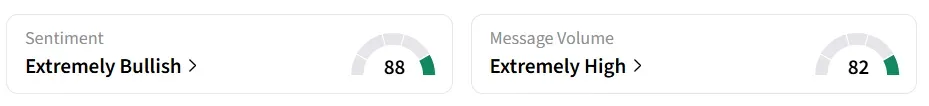

Wendy’s stock traded over 2% higher by Friday mid-morning. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume jumped to ‘extremely high’ from ‘normal’ levels in 24 hours.

A bullish Stocktwits user lauded the earnings.

Another user believes the stock is way undervalued.

Q3 Highlights

Wendy’s reported a Q3 revenue of $549.5 million and an adjusted earnings per share (EPS) of $0.25. Both revenue and EPS surpassed the analysts’ consensus estimate of $534.5 million and $0.2, respectively, according to Fiscal AI data.

Global systemwide sales growth fell 2.5% year-on-year (YoY) with a 4.4% slump in the U.S. and an 8.6% YoY increase internationally.

For 2025, the company expects global systemwide sales to decrease between 3% and 5%, and an adjusted EPS between $0.82 and $0.89.

WEN stock has lost 44% in 2025 and over 54% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)