Advertisement|Remove ads.

AMPX Stock Sees Over 280% Surge In Retail Chatter Over 24 Hours: What’s Driving The Investor Interest?

- The jump in sales was propelled by both new customers and expanded orders from existing clients.

- Both Q3 revenue and EPS came in above the Street estimates.

- Amprius ended the quarter with $73.2 million in cash and zero debt.

Amprius Technologies, Inc. (AMPX) stock drew increased retail chatter on Friday after the company reported strong third-quarter (Q3) revenue supported by a rise in new customers and larger orders from existing ones.

The firm reported a Q3 revenue of $21.4 million, marking a 42% year-on-year (YoY) surge, and posted a loss per share (EPS) of $0.03. Both revenue and EPS figures came in better than the analysts’ consensus estimates of $17.46 million in revenue and a loss per share of $0.06, respectively, according to Fiscal AI data.

Customer Momentum

According to the lithium-ion battery producer, the surge in sales was driven by both new customers and increased orders from existing clients. Only one customer accounted for more than 10% of Q3 revenue, reflecting increased diversification.

The backlog stood at $53.3 million, including a $35 million order from a UAS manufacturer, representing an 83% quarter-on-quarter increase. Amprius’ stock traded over 2% higher on Friday, after the morning bell.

Amprius ended the quarter with $73.2 million in cash and zero debt. Operating cash flow used was $9.2 million.

What Are Stocktwits Users Saying?

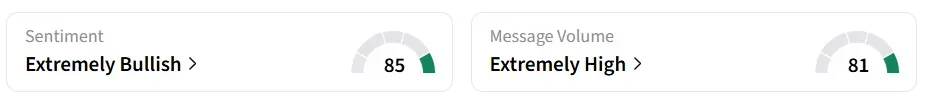

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock experienced a 286% surge in user message count over 24 hours.

A Stocktwits user called the timing perfect for loading the shares, highlighting the gloomy overall market sentiment.

The company is expanding supply-chain capacity and manufacturing at its Fremont, California, facility with support from a $12 million contract awarded in Q3 by the U.S. Government’s Defense Innovation Unit.

AMPX stock has gained over 303% in 2025 and over 781% in the last 12 months.

Also See: Why Did Navitas Semiconductor Stock Tumble 14% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)