Advertisement|Remove ads.

What Is Price-To-Earnings Ratio And Why Does It Matter?

- The P/E ratio is considered one of the most important financial ratios as it helps analysts compare a company’s valuation over time or relative to peers.

- There are two types of P/E ratios: the trailing P/E and the forward P/E.

- The trailing P/E ratio offers a backward-looking perspective while the forward P/E reflects analysts’ estimates of future earnings.

The price-to-earnings (P/E) ratio is a widely used metric among investors to gauge a company’s valuation. The metric is derived by dividing the share price by earnings per share, which shows how much investors are willing to pay for one dollar of earnings.

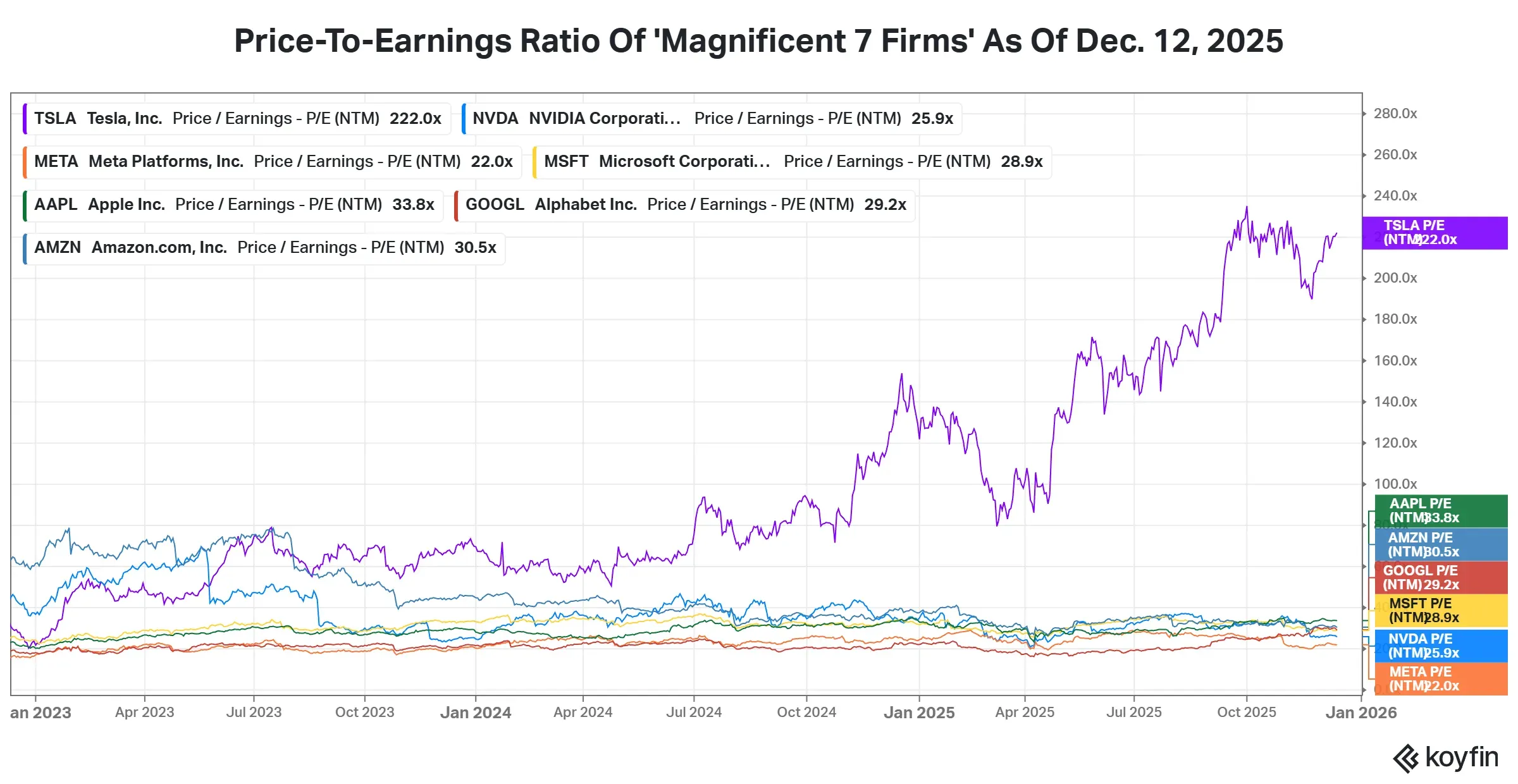

A higher P/E typically signals greater confidence in future growth, while a lower reading may reflect weaker expectations or a discounted valuation. According to the Corporate Finance Institute, the appeal of the P/E ratio lies in its simplicity, which allows investors to compare companies of different sizes.

How Investors Use P/E Ratio

Investors commonly use the P/E ratio as an initial step in judging whether stocks appear expensive or undervalued. It is widely adopted because the value can be compared across sectors or against the broader market.

The P/E ratio is considered one of the most important financial ratios as it helps analysts compare a company’s valuation over time or relative to peers. It also helps detect if a company’s share price is in sync with its earnings.

Types Of P/E Ratios

There are two common types of P/E ratios. The trailing P/E ratio uses reported earnings over the past 12 months, offering a backward-looking perspective. This approach provides stability since it uses confirmed numbers. The forward P/E, by contrast, reflects analysts’ estimates of future earnings.

CFI noted that this version provides investors with a sense of expected growth, though the metric's accuracy depends heavily on the reliability of forecasts. Differences between the two can show how sharply earnings are expected to rise or fall.

Limitations

Limitations

The metric remains an indispensable tool for investors because it provides an immediate view of how the market is valuing a particular company. However, it has some limitations. Earnings can swing dramatically; thus, the ratio may not be so reliable in providing an accurate picture of a firm with volatile earnings or negative profits.

Valuation norms also differ widely across sectors, so a high multiple in one industry may be standard in another. For example, high-growth tech stocks trade at higher multiples than utility stocks.

To get a clearer picture, analysts typically pair the P/E with other measures such as price-to-book and price-to-sales ratios. Even with its shortcomings, the P/E ratio remains a key reference point for investors.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)