Advertisement|Remove ads.

This Nano-cap Pharma Stock Crashed 30% Today – What Triggered The Sell-off?

- The action will reduce outstanding shares from about 143.7 million to 958,000.

- The move is aimed at boosting the share price to regain compliance with Nasdaq’s $1 minimum bid price requirement.

- SXTC shares have been under intense selling pressure since the turn of the year, declining more than 75%.

Shares of China SXT Pharmaceuticals (SXTC) plunged nearly 30% on Friday after the company announced a 1-for-150 reverse share split, effective Feb. 3, 2026.

SXTC stock will begin trading on a post-split basis the same day under the existing ticker symbol. The move is aimed at boosting the share price to regain compliance with Nasdaq’s $1 minimum bid price requirement. The stock is currently trading around $0.3.

The move will consolidate every 150 existing Class A shares into one new share, reducing the outstanding shares from about 143.7 million to 958,000, with fractional shares rounded up.

Selling Pressure

SXTC shares have been under immense selling pressure since the turn of the year, declining more than 75%. On January 9, the stock tanked 87% after the company signed a deal with a single investor to sell about 66.7 million Class A shares, or pre-funded warrants, at $0.15 each, for gross proceeds of around $10 million. The per-share offer was at an 88% discount.

Recently, China SXT Pharmaceuticals launched an AI initiative to modernize the traditional Chinese medicine raw-material supply chain. The company said it would explore AI tools for cultivation monitoring, authenticity checks, quality grading, and demand forecasting to boost traceability and planning efficiency.

The company’s last reported quarterly results were for the quarter ended September 2025, when its net loss widened to $6.3 million from about $0.8 million a year earlier.

How Did Stocktwits Users React?

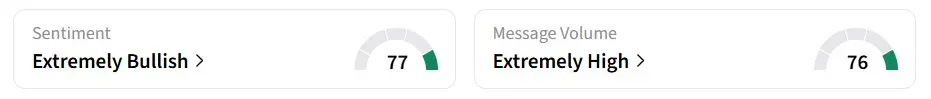

Despite the steep intra-day decline, retail sentiment on Stocktwits remained ‘extremely bullish’ over the past 24 hours, amid ‘extremely high’ message volumes.

Read also: Gold Falls Below $5,000, Spot Silver Plunges 20%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)