Advertisement|Remove ads.

Why Anthropic’s IPO Might Just Be Juicier Than OpenAI’s

- Anthropic has reportedly retained a law firm to start its IPO process, aiming to go public as early as next year.

- Months ago, reports speculated that OpenAI had also started discussions for an IPO for the next year or 2027.

- The simultaneous high-stakes IPOs might present challenges, even as investors appreciate their different approaches and financial goals.

Anthropic, the Amazon- and Google-backed firm behind the Claude AI chatbot, is reportedly preparing for an initial public offering that could come as early as next year – potentially pitting its IPO against that of OpenAI.

The development presents a new twist in AI rivalries, just as a power-packed year of innovation and soaring tech valuations draws to a close, and could have wide implications for the sector.

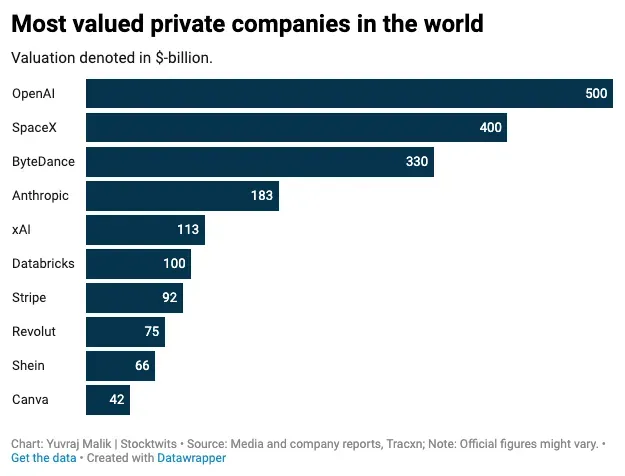

Anthropic was last valued at about $180 billion, which is about a third of OpenAI’s reported $500 billion valuation. Still, it is poised to be one of the largest IPOs ever. The Financial Times reported that the company has retained law firm Wilson Sonsini to launch the process and is reportedly seeking a valuation of $300 billion. OpenAI, on the other hand, is proceeding at a slower pace, although a previous report said it could file the paperwork with the markets regulator in the second half of 2026.

Different Approaches

Simultaneous high-stakes IPOs present a number of challenges: For one, investors might be forced to invest in only one of the companies, given the likely high asking prices, making it a competition to win over investors.

The other issue is pricing, and benchmarking them might not be easy. OpenAI and Anthropic have widely different approaches. With an eye-popping $1.4 trillion cloud investment commitment, OpenAI is more aggressive. However, Anthropic has broader penetration among enterprise customers.

OpenAI | Anthropic | |

| Founding year | 2015 | 2021 |

| Funding raised | $58 billion | $27.3 billion |

| Investors | Microsoft (primary backer), Thrive Capital, Khosla Ventures, Nvidia, SoftBank, Fidelity, MGX | Amazon, Google (primary backers), Salesforce, Spark Capital, Menlo Ventures, Iconiq, Jane Street. |

| 2025 revenue (projected) | $20 billion | $7 billion |

| Userbase (monthly active) | 800 million | 20 million |

| Major institutional customers | Morgan Stanley, Salesforce, PwC, Stripe, Duolingo, Moderna, Rakuten | Pfizer, Zoom, Bridgewater Associates, BCG, Perplexity, Intuit |

Source: Media and company reports, Tracxn; Note: The table is not exhaustive

Financials

From a public market perspective, Anthropic’s report card looks slightly better at this point. The FT reported last month that Anthropic’s internal projections show it expects to turn in a profit in 2028.

By contrast, OpenAI forecasts $74 billion in operating losses that year, roughly three-fourths of its projected revenue, largely due to ballooning spending on computing costs.

This year, Anthropic could clock $4.2 billion in sales, the FT reported; OpenAI's CEO Sam Altman earlier said the company would finish the current year with $20 billion in annualized revenue and “hundreds of billions by 2030.”

Altman Declares ‘Code Red’ After Gemini 3

The development comes as OpenAI finds itself cornered. After Google’s Gemini 3 and Nano Bananas enthralled users in the last few weeks, Altman has declared a “code red” at the company, telling staff to prioritize major improvements to ChatGPT.

According to internal memos, OpenAI is pausing projects such as ads, shopping tools, health agents, and its Pulse assistant to focus on faster, more reliable, and more personalized performance for ChatGPT. Teams will join daily calls, and employees are encouraged to shift temporarily to speed up the upgrades.

AI Bubble?

Then there is the question of the “AI bubble,” and the uncertainty around markets’ perception of AI next year. Over the past few months, several prominent voices, including JPMorgan CEO Jamie Dimon, have raised concerns about a perceived mismatch between billions of dollars in AI investment and future returns.

Those concerns led to a broad sell-off in the U.S. market last month. Meanwhile, analysts have said that while OpenAI is the largest player with the highest consumer mindshare, its gaps with the number two and three would shrink in the coming years.

That said, with strong market performance of newly listed CoreWeave and Circle Internet, and the still record-at-record valuations of Nvidia and Alphabet – all major AI-linked stocks – investors might shell out big cash for both OpenAI and Anthropic next year despite their red bottom lines.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)