Advertisement|Remove ads.

The Prediction Markets Rush: Polymarket, Kalshi Are Ascending Fast — And Sportsbooks DraftKings And Flutter Are On High Alert

- Prediction market platforms Polymarket and Kalshi recently raised mega funding rounds and are aggressively expanding through sports wagers and partnerships.

- Their rise has disrupted sportsbooks' businesses, with DraftKings and Flutter now planning their own foray into prediction markets.

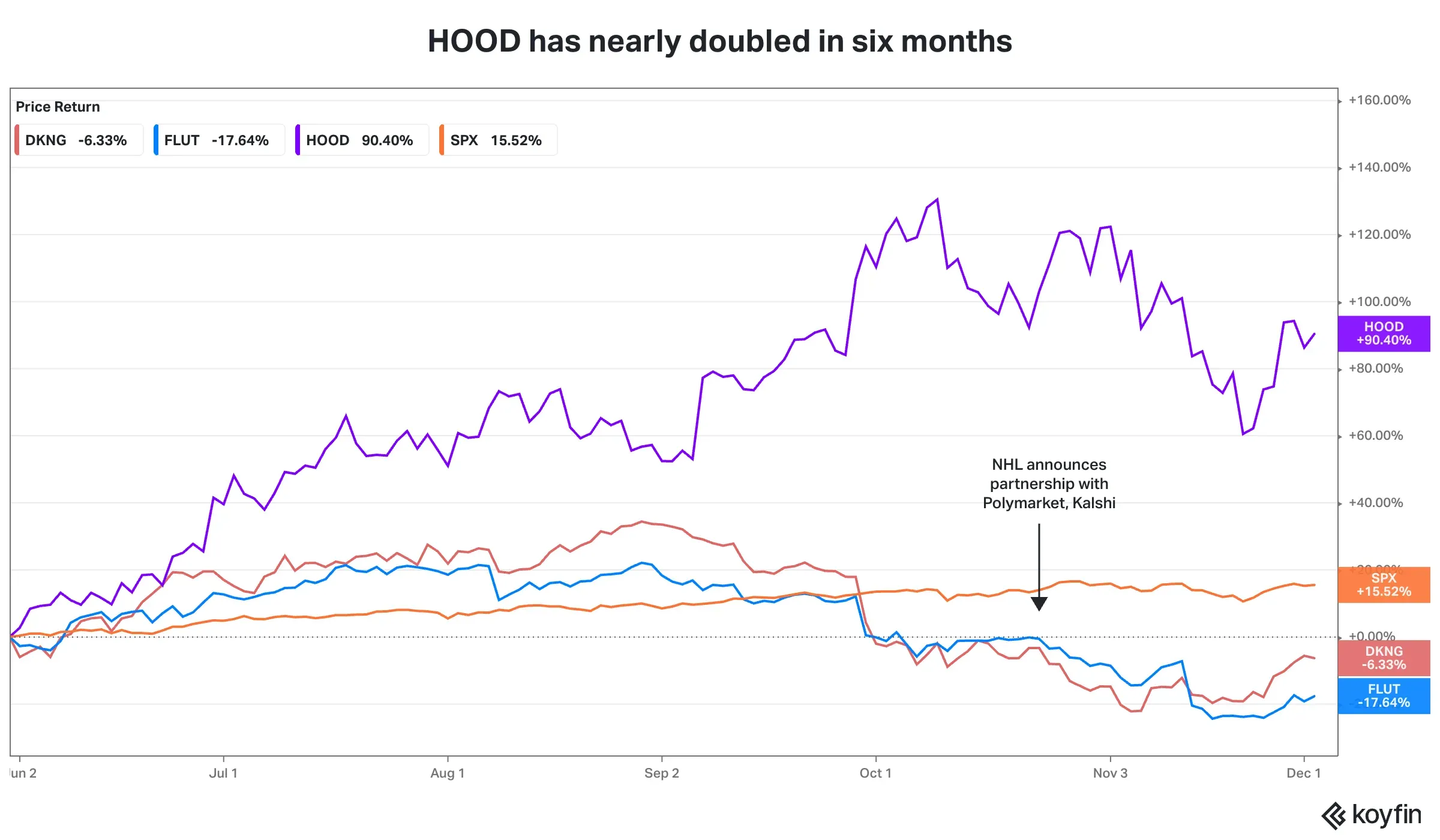

- Robinhood, which launched a prediction-market hub in March, has seen its stock rally sharply.

Step back from the wall-to-wall AI buzz for a moment, and another fast-rising business trend comes into focus: prediction markets.

Top platforms in the space – Polymarket, Kalshi, and Robinhood’s Prediction Markets Hub – have scaled aggressively this year. Their wagers on everything from markets to politics, sports, and culture are drawing massive interest from users across the United States, as well as from financial entities looking to use their prediction data in novel ways.

Incredible Growth

Kalshi on Tuesday secured $1 billion at an $11 billion valuation, marking its third fundraise of the year and more than doubling its valuation in just a few months. The platform shot to prominence as users piled into contracts ahead of November 2024’s presidential election, which saw Donald Trump win, and has since aggressively expanded into sports betting.

Polymarket bagged a $2 billion cheque from the New York Stock Exchange operator Intercontinental Exchange, Inc. (ICE) two months ago, at a pre-investment valuation of $8 billion. As part of the deal, ICE will also distribute Polymarket’s event-driven data, providing customers with sentiment indicators on market-relevant topics.

And Robinhood? Its stock has been on an absolute tear — HOOD is up more than threefold this year — helped in part by its aggressive push into prediction markets. The company rolled out its prediction-market hub with Kalshi in March and, just last month, snapped up a 90% stake in MIAX Derivatives Exchange, a move that sent its shares sharply higher.

| Platform | Primary Volume Driver in November 2025 | Broadly Popular Contracts (Last 6 Months) | Key Metric/Note |

| Kalshi | Sports-related contracts (Pro Football, NHL, NBA, etc.) | Sports: NFL game outcomes and championships (dominant volume driver). Economics: Fed Interest Rate Decisions, Inflation, Recession probabilities | Posted a monthly spot volume of $5.8 billion in November, driven primarily by sports |

| Polymarket | Macroeconomics and Politics (US Fed, Global Elections) | Politics: US Presidential Nominees (2028), Global Elections, Political events. Macro: Fed Interest Rate Decisions, Bitcoin/Crypto prices | Posted a monthly trading volume of $3.7 billion in November, with large volumes in its staple macro/political markets |

| Robinhood | Sports and Federal Reserve Rates | Sports: NFL, NCAA March Madness, other major US sports leagues. Economics: Fed Interest Rate Decisions, CPI/Inflation | Fastest-growing revenue line for Robinhood. Trading 2.5 billion contracts in October, and over 9 billion since its launch in March 2025 |

Note: The table offers only an overview. Source: Stocktwits research

Sportsbooks On Alert

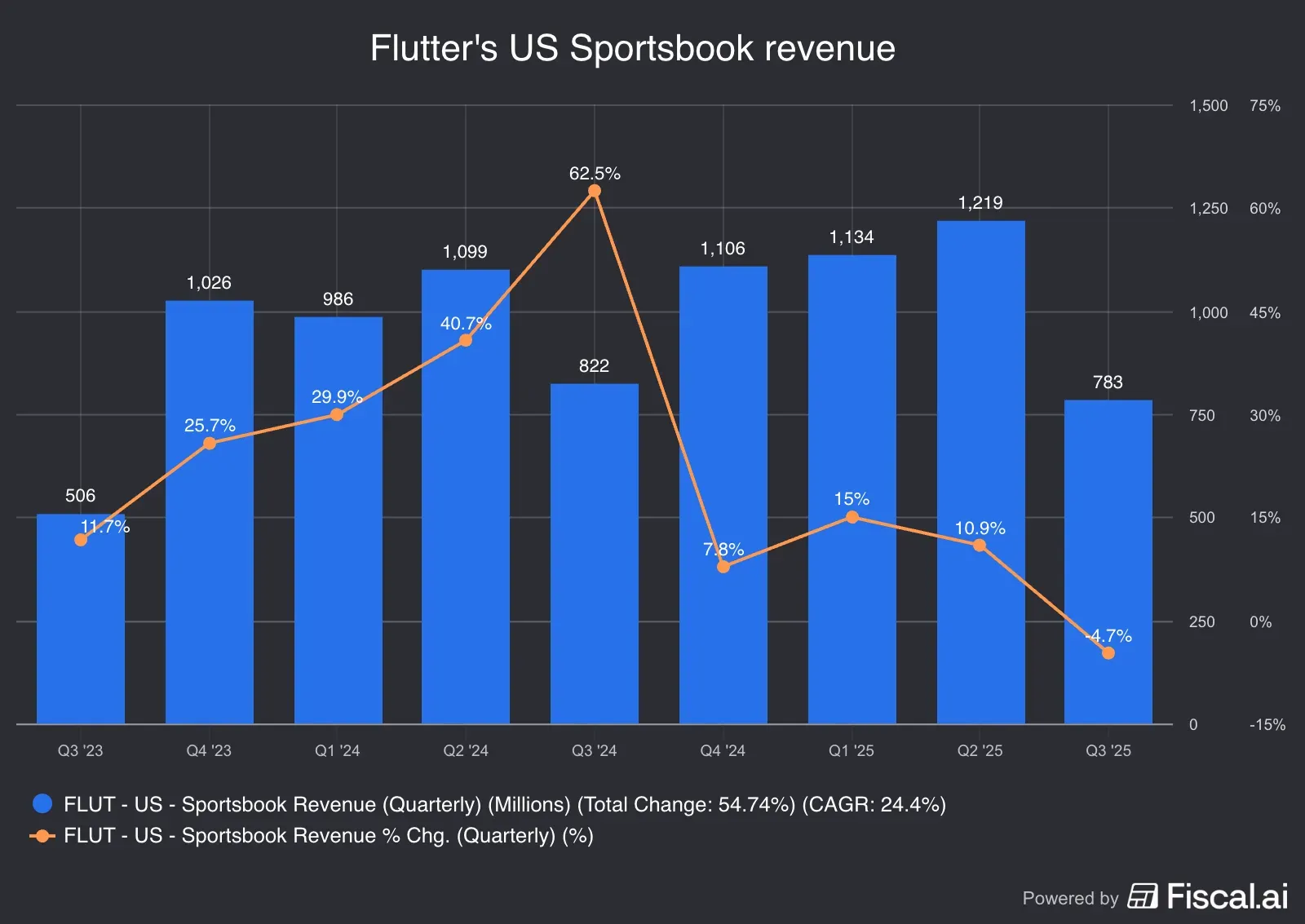

That’s all great, but the surge of prediction markets is also shaking up a core industry: sportsbooks. Giants like DraftKings and Flutter Entertainment, which owns FanDuel, are quietly growing uneasy and have announced plans to roll out their own prediction-market products as soon as this month or next. Flutter is building one through a partnership with CME Group, while DraftKings will launch one following its recent acquisition of Railbird Technologies.

In recent interviews, DraftKings and Flutter management have said that sportsbooks and prediction markets are two distinct offerings and, as such, would not cannibalize each other's user bases. To be sure, sportsbooks account for about half of their topline, with the rest coming mostly from iGaming (casino, poker, bingo, and lottery games, both online and on the apps).

However, some recent products, like same-game parlays, strike right at the core of DraftKings’ and Flutter’s core sportbook offerings. What’s more, when Polymarket and Kalshi signed a major deal with the National Hockey League, the first major U.S. sports league to license its trademarks to prediction markets, DKNG and FLUT stocks did not take it kindly.

In fact, recent results from both show weak sportsbook revenues, though that’s also due to customer-friendly results in this NFL season. Nevertheless, DraftKings tightened its annual forecast. Some analysts are concerned, too.

Wider Appeal

Prediction-market platforms are forging partnerships at breakneck speed to broaden their appeal, and also offering everything from outlandish contracts on meteor strikes or nuclear detonations to more audience-friendly wagers on Oscar winners or Time’s Person of the Year.

Historically, platforms like Kalshi were focused on politics, macroeconomic events, weather, and other “non-sports” outcomes. The 2025 wave of partnerships with major sports leagues (NHL, UFC) and mainstream finance and media outlets (Google Finance, Yahoo Finance) marks a pivot — from fringe financial “bets” to broadly accepted, regulated event-trading tools across sports, entertainment, and finance.

"Kalshi is replacing debate, subjectivity, and talk with markets, accuracy, and truth," CEO Tarek Mansour said in a statement on Tuesday. “We have created a new way of consuming and engaging with information. It’s hard to have an opinion about the future today without thinking about Kalshi.”

DKNG and FLUT shares are down 10% and 19.3% year-to-date, respectively, with their recent Stocktwits sentiment as ‘bearish.’ HOOD is up 227% and also had a ‘bearish’ sentiment.

Editor’s note: Stocktwits and Polymarket have a partnership that provides retail investors with prediction data and insights on the Stocktwits platform.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233231242_jpg_8d76eb3b7a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sarepta_cf8e97de31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)