Advertisement|Remove ads.

Bullish On Battered Solar Stock? Retail Investors Bet On Brighter Days For Maxeon

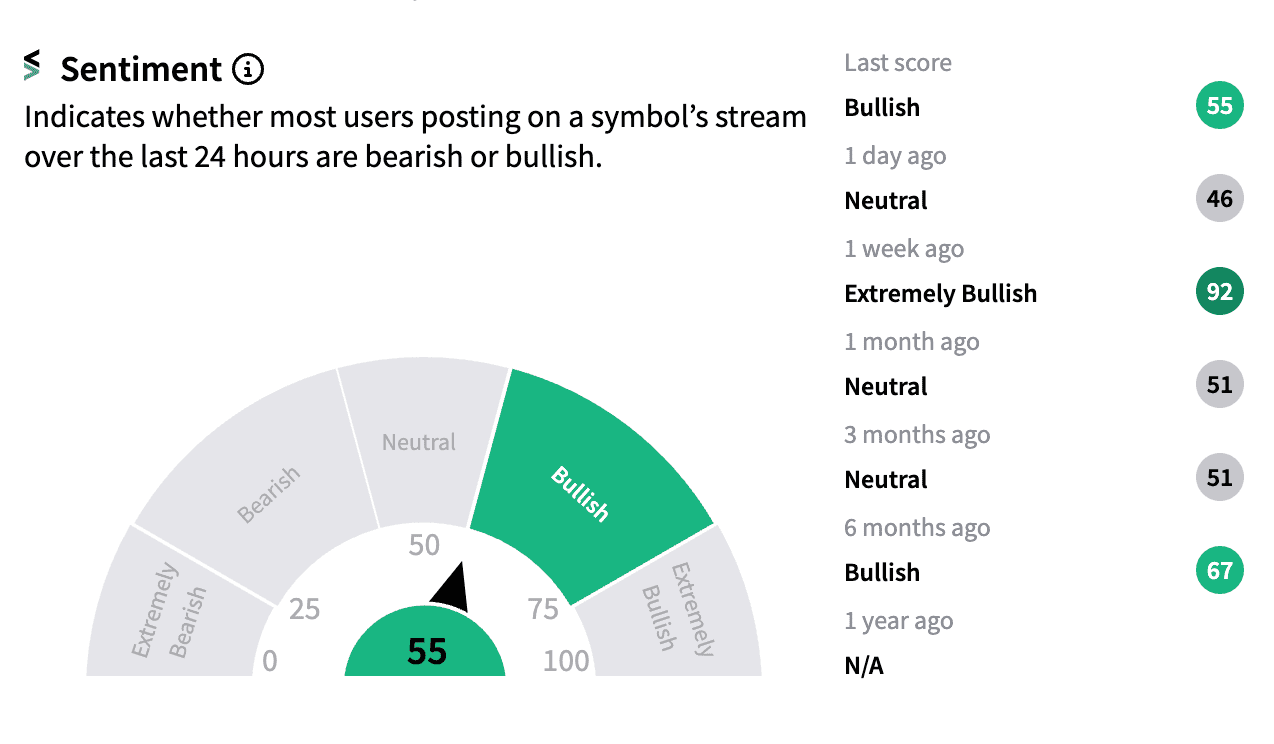

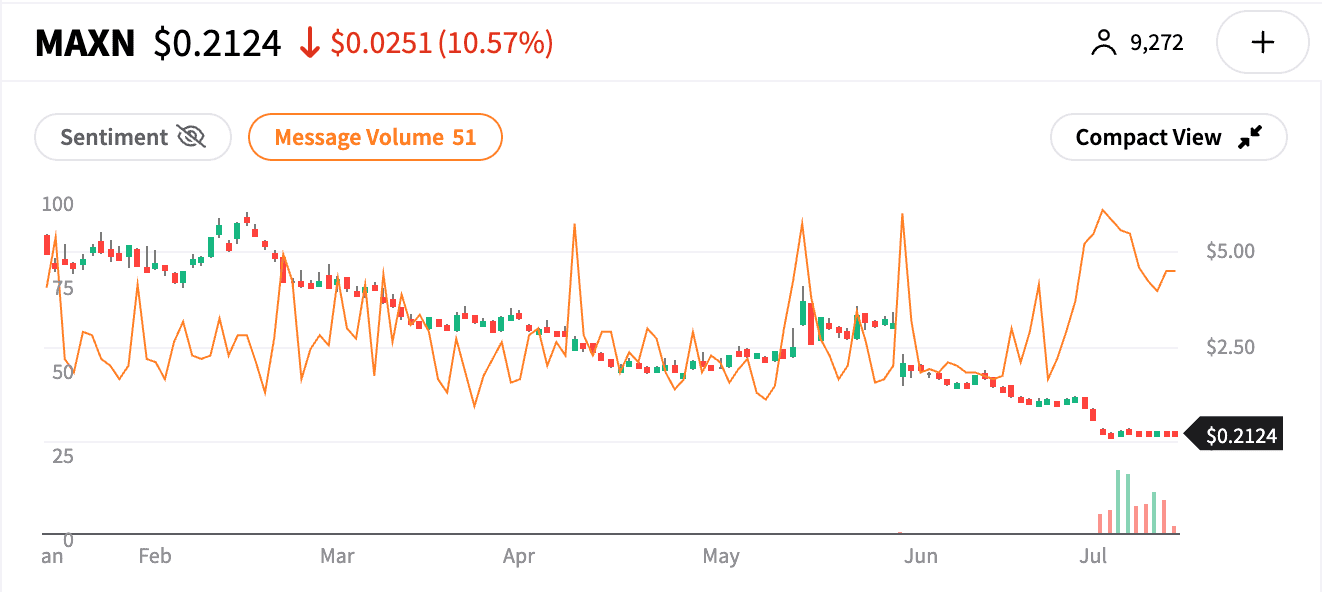

Maxeon Solar Technologies Ltd. has been in a freefall, with its stock price down a staggering 96.87% year-to-date compared to the S&P 500's 18% gain. Despite this plunge, retail investors have shown surprising optimism, reflected in a moderately bullish Stocktwits sentiment score of 55/100. Notably, the stock has seen the highest weekly change in message volume over the past two weeks.

Just over six months ago, Maxeon's market cap exceeded $1.8 billion. Now, its value has plummeted to a mere $13.23 million. The stock has consistently traded below its 50-day moving average for over a month and exhibits an average daily trading volume of 5.9 million shares.

In Q1 2024, the Singapore-based company reported a significant revenue decline to $187 million from $318.3 million a year earlier, citing challenging market conditions, rising borrowing costs, and regulatory shifts impacting demand.

The company's situation worsened after issuing a "going concern" warning. Its main stakeholder, TCL Zhonghuan Renewable Energy Technologies, also announced a $197.5 million investment ($100 million in stock and $97.5 million in debt). This move, however, caused significant share dilution.

It also faces multiple shareholder lawsuits alleging an undisclosed reliance on exclusive sales to SunPower.

The broader solar energy sector has also faced headwinds recently, with slowing demand due to high interest rates. Sunnova shares have plunged over 54% year-to-date, while Enphase Energy, Sunrun, and SolarEdge have declined 14%, 21%, and 70%, respectively.

Maxeon faces an additional challenge with a high short interest of nearly 78% of its free float, indicating significant bearish sentiment from institutions. This high short interest could potentially lead to a short squeeze, similar to those seen with meme stocks, but the stock lacks a clear catalyst to initiate that type of move.

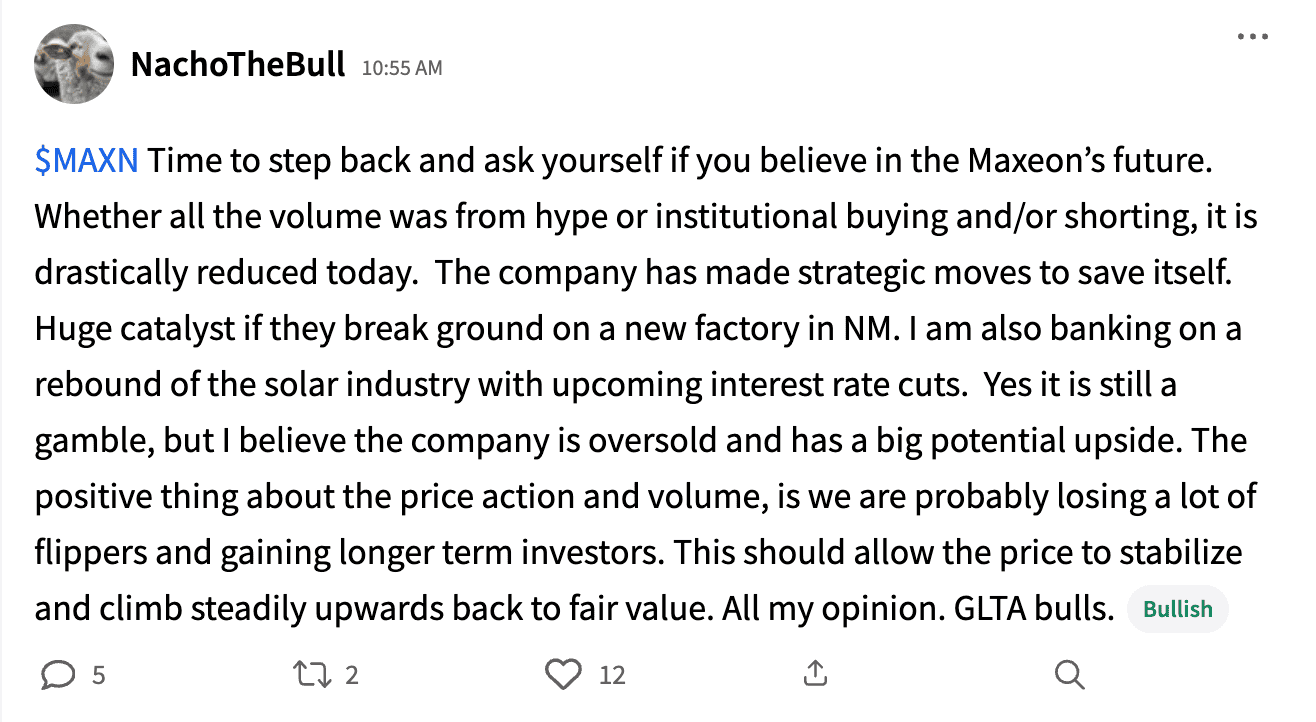

Interestingly, Stocktwits activity suggests that many retail investors remain optimistic about Maxeon's potential, citing factors like the planned $1 billion New Mexico plant construction bolstered by the Inflation Reduction Act.

One such bullish voice, user NachoTheBull, expressed optimism: "Huge catalyst if they break ground on the new factory in NM. I'm also banking on a turnaround in the solar industry with upcoming interest rate cuts. Yes, it's still a gamble, but I believe the company is oversold and has significant upside potential."

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Gold_Silver_jpg_c77de4fb71.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)