Advertisement|Remove ads.

Why Did Canadian Solar Stock Surge In Premarket Today?

- Gross margin stood at 17.2%, exceeding the company’s guidance of 14% to 16%

- Its e-STORAGE unit delivered a record 2.7 GWh of battery energy storage shipments, exceeding company estimates.

- Canadian Solar was among the top trending ticker on Stocktwits.

Shares of Canadian Solar Inc. (CSIQ) jumped over 13% in premarket trading on Thursday, after the company posted a better-than-expected third quarter print.

Net revenues came in at $1.5 billion, the higher end of the company’s guidance of $1.3 billion to $1.5 billion, and beating Stocktwits’ estimates of $1.36 billion. Gross margin stood at 17.2%, exceeding CSIQ’s guidance of 14% to 16%.

Its e-STORAGE unit delivered a record 2.7 GWh of battery energy storage shipments, surpassing its 2.1 - 2.3 GWh guidance, while its contracted backlog rose to $3.1 billion as of October 31, 2025.

“Demand for energy storage continues to grow, driven by emerging applications such as data centers. I am pleased to share that our residential energy storage business is on track to become profitable in 2025. At the same time, we are making strong progress on our manufacturing facilities in the U.S. Construction of our solar cell factory in Indiana and our integrated lithium battery cell, pack, and BESS factory in Kentucky is progressing as planned, with production expected to commence in the first and fourth quarters of 2026, respectively,” said Shawn Qu, Chairman and CEO of Canadian Solar.

Outlook

For the fourth quarter of 2025, Canadian Solar projects revenue between $1.3 billion and $1.5 billion, with a gross margin of 14% - 16%. The company expects CSI Solar’s module shipments to range from 4.6 GW to 4.8 GW, and battery energy storage shipments to be between 2.1 GWh and 2.3 GWh, including approximately 600 MWh supplied to its own projects.

For full-year 2026, CSI Solar anticipates total module shipments of 25 GW to 30 GW, which includes roughly 1 GW for internal projects, and battery energy storage shipments of 14 GWh to 17 GWh.

What Are Stocktwits Users Saying?

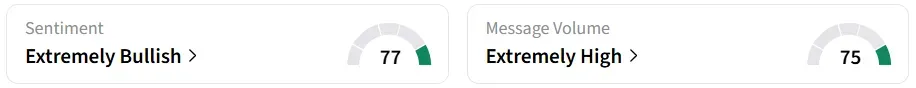

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a session earlier, amid ‘high’ message volumes. It was also among the top trending ticker on the platform.

One user believes that the CSIQ stock is underpriced.

CSIQ shares have gained over 150% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)