Advertisement|Remove ads.

Why Did Chipotle Stock Rise 2% After-Hours?

Chipotle Mexican Grill shares rose 2% in after-hours trading on Monday, after the company announced a $500 million share buyback plan.

Including the latest authorization, Chipotle's share repurchase plan has a total authorization of about $750 million as of Sept. 15, the company said. There is no expiration date for the share repurchase program.

The development comes amid a period of acute weakness of the stock. CMG shares are down 27% since its quarterly report on July 23, when the company reported lower-than-expected revenue and same-store sales and slashed its comparable sales forecast for the year.

Year-to-date, the stock is down 36%, compared to the nearly 1% rise in AdvisorShares Restaurant ETF (EATZ), a benchmark for U.S. restaurants and fast chain stocks.

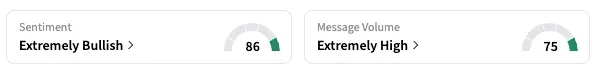

The slide, meanwhile, is likely getting retail users excited. On Stocktwits, the retail sentiment moved several notches higher in the 'extremely bullish' zone (86/100), with users discussing buy calls.

The management has stated that as economic pressures ease and spending trends improve, customers will return to the burrito chain in a significant way, given its value proposition and innovative menus.

Last week, Chipotle announced a plan to open its restaurants in South Korea and Singapore next year. At the time, users viewed the development positively and speculated that CMG shares may have reached their bottom.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)