Advertisement|Remove ads.

Why Did Clearwater Analytics Stock Gain On Wednesday?

- Clearwater has reportedly reached out to advisers to evaluate options and attract potential buyers.

- The stock has gained for the past three sessions, after the company reported a strong revenue jump in Q3.

- Retail sentiment on Stocktwits has turned ‘extremely bullish’ from ‘bullish’ a session earlier.

Shares of Clearwater Analytics Holdings Inc. (CWAN) gained 12.2% in premarket trade on Wednesday, after Bloomberg reported that the company is exploring a potential sale after receiving takeover interest.

The Idaho-based company, which provides investment and accounting software to financial institutions, has reportedly engaged advisers to evaluate its strategic options and attract potential buyers.

Discussions are reportedly in the early stages, and there is no guarantee that they will result in a deal. Clearwater has declined to comment on the ongoing deliberations, the report added. The company has a market cap of $5.38 billion, according to Stocktwits data.

Additional details of the potential deal were not given.

Stock Climbs Post Q3 Results

The stock has been on a steady climb since hitting a 52-week low on November 6. On Tuesday, CWAN shares surged 10.25% to close at $18.40. The rebound came amid strong revenue growth despite a sharp drop in profitability.

For the third quarter, Clearwater reported a net loss of $10.3 million, compared with a $3.6 million profit in the same period last year. However, revenue jumped 77% to $205 million, surpassing its guidance range of $203 - $204 million.

The company expects full-year revenue between $730 million and $731 million, representing a 62% annual increase. Fourth-quarter revenue is projected to be $216–$217 million, implying year-over-year growth of 71%-72%.

What Are Stocktwits Users Saying?

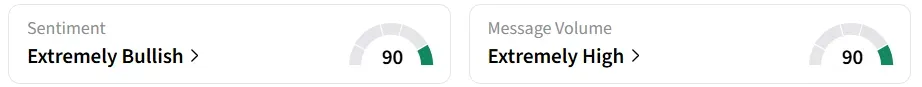

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a session earlier, accompanied by ‘extremely high’ message volumes. It was also among the trending stocks on the platform.

A user was eyeing a mid-20s price target for the stock, given its current price of $20.6.

Year-to-date, the stock has shed over a third of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)