Advertisement|Remove ads.

Why Did Genesco Stock Tumble Nearly 30% Today?

- Genesco’s fiscal third-quarter adjusted earnings of $0.79 per share missed estimates of $0.88 per share, according to Fiscal.ai data.

- The firm also projected adjusted earnings per share from continuing operations to be around $0.95, down from its prior expectation of $1.30 to $1.70.

- Genesco CEO said that Cyber Monday and Black Friday sales have been encouraging, and the company is taking actions to mitigate the decline in demand.

Genesco (GCO) stock tumbled nearly 30% on Thursday, on track for the worst day in two and a half years, after the footwear retailer lowered its annual outlook due to tepid demand in the U.K.

The company projected fiscal 2026 total sales to be up about 2% and comparable sales to be up about 3% compared to the previous year, down from the prior forecast for total sales to be up 3% to 4% and comparable sales up 4% to 5%. It also projected adjusted earnings per share from continuing operations to be around $0.95, down from its prior expectation of $1.30 to $1.70.

Weak U.K. Demand Weighs

Genesco CEO Mimi Vaughn stated in a call with analysts that the U.K. retail environment remains very challenging. “Currently, the U.K. footwear customer is focused either on must-have items with much less interest in the rest of the assortment or is looking for a deal to spur a purchase,” she said.

U.K. retail sales declined in October, according to British government data released last month. The numbers provided further evidence of softening consumer spending, coming just before Finance Minister Rachel Reeves raised taxes in her budget last week. Genesco bought the U.K.-based footwear retailer Schuh in 2011.

“We have also moderated the growth assumptions for our other businesses based on the footwear, consumer traffic, and spending patterns we've witnessed on non-peak shopping days,” Vaughn said. However, she noted that Cyber Monday and Black Friday sales have been encouraging, and the company is taking actions to mitigate the decline in demand.

Q3 Earnings

The company’s fiscal third-quarter adjusted earnings of $0.79 per share missed estimates of $0.88 per share, according to Fiscal.ai data. Its fiscal third-quarter sales of $616 million also came in below analysts’ expectations.

“In the third quarter, demand was even stronger than we expected during the heart of back-to-school, and then traffic and purchase intent softened considerably and more than we expected in the weeks following, with an especially challenging October,” Vaughn said. Higher tariffs also affected its margins.

What Are Stocktwits Users Thinking?

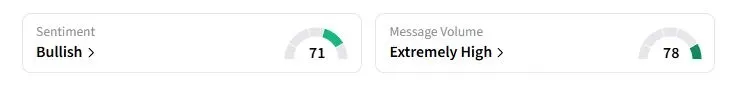

Retail sentiment on Stocktwits about Genesco, however, flipped to ‘bullish’ from ‘bearish’ a day ago.

Genesco shares have fallen nearly 43% this year.

Also See: What Is A Block Trade?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Express_resized_d6044f410d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_axsome_resized_jpg_09f7c99fb1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)