Advertisement|Remove ads.

Why Did Gulf Island Fabrication Stock Surge To Over 7-Year Highs Today?

- The transaction, valued at $12.00 per share, implies a 52% premium over GIFI’s closing price of $7.87 on Thursday.

- IES Holdings said the transaction aligns with its U.S. infrastructure priorities.

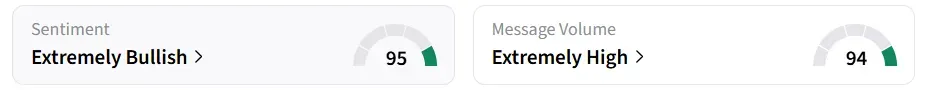

- Retail sentiment for GIFI stock on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a day back.

Shares of Gulf Island Fabrication, Inc. (GIFI) shot up nearly 50% on Friday to their highest level in over seven years after IES Holdings (IESC) announced that it would acquire the metal fabricator for $192 million.

The transaction, valued at $12.00 per share, implies a 52% premium over GIFI’s closing price of $7.87 on Thursday. The deal is expected to close by the quarter ending March 31, 2026.

IESC stock was down nearly 5% at the time of writing.

Acquisition Rationale

The acquisition will enhance IES Holding’s industrial and infrastructure capabilities through Gulf Island’s 450,000-square-foot fabrication facility in Houma, Louisiana, a strategically located Gulf Coast campus spanning 160 acres. IES said the transaction aligns with its U.S. infrastructure priorities.

“Gulf Island’s team and its Houma footprint strategically expand our capabilities to deliver complex steel structures and specialty services that support our continued growth in the data center market as well as the building and rebuilding of U.S. infrastructure,” said Matt Simmes, President and CEO of IES.

In light of the proposed transaction, Gulf Island announced that it will not hold an earnings conference call to discuss its third-quarter results, which are due after market hours on November 11.

According to Stocktwits' estimates, GIFI’s Q3 revenue is expected to be $34 million. The company beat revenue estimates in each of the last three quarters.

What Does Stocktwits Data Say?

Retail sentiment flipped to ‘extremely bullish’ from ‘neutral’ a session earlier, accompanied by ‘extremely high’ message volumes.

Around 379,000 shares changed hands in just over two hours of trade, more than eight times the average.

Year-to-date, GIFI shares have gained by 73%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)