Advertisement|Remove ads.

Why Did LRHC Stock Surge Over 40% Today?

- Together with its $1 billion equity purchase facility, La Rosa now has access to up to $1.25 billion in total financing capacity.

- The company said the funds will support its shift toward developing data center infrastructure for AI computing.

- La Rosa Holdings had previously said it would pursue strategic acquisitions and joint ventures with technology and infrastructure partners.

Shares of La Rosa Holdings Corp. (LRHC) rose more than 40% on Friday after the real estate firm announced the initial closing of an $11 million note under a previously disclosed $250 million private placement convertible note facility.

Combined with its existing $1 billion equity purchase facility, this provides La Rosa with access to up to $1.25 billion in total financing capacity.

On Friday, LRHC stock saw its biggest intraday gain since July 3, 2025.

AI Data Center Pivot

La Rosa said the funds will be used to build a strategic reserve to support long-term growth. It is expected to support the company’s shift toward developing next-generation data center infrastructure for artificial intelligence computing. Last November, La Rosa announced plans to pursue strategic acquisitions and joint ventures with established technology and infrastructure partners.

“Closing the initial tranche of our $250 million facility is a milestone that strengthens our investable assets and moves us from the evaluation phase to the execution phase. With $1.25 billion in total potential capital access, we are now positioned to act decisively on our pipeline of AI infrastructure that could drive long-term value for our shareholders,” said Joe La Rosa, CEO of La Rosa.

How Did Stocktwits Users React?

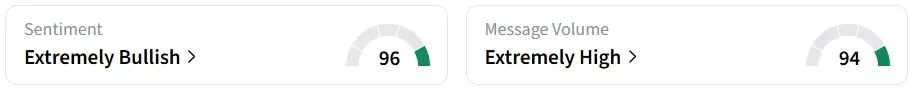

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes.

One user sees $1.28 as a crucial resistance point. The stock is currently trading at $1.1

In November, the company reported a 3% rise in its third-quarter (Q3) revenue to $20.2 million, while net loss widened to $5.5 million, up from $3.4 million a year earlier.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)