Advertisement|Remove ads.

Why Did Lululemon Stock Plummet Over 15% After-Hours Today?

Lululemon Athletica (LULU) shares tanked 15.8% in extended trading on Thursday, after the company slashed its annual profit and sales forecasts.

The athleisure maker projected annual revenue between $10.85 billion and $11 billion, compared with its previous forecast between $11.15 billion and $11.30 billion. It also slashed its profit forecast to the range of $12.77 to $12.97 per share, compared with prior projections of $14.58 to $14.78 per share in profit.

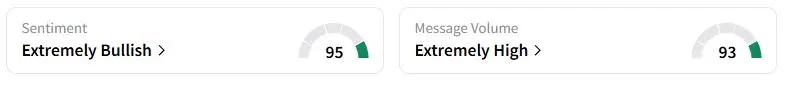

Lululemon was the top trending ticker on Stocktwits at the time of writing. Retail sentiment was still in the ‘extremely bullish’ territory at the time of writing, while chatter was ‘extremely high.’

A large part of the forecast cut was driven by its U.S. business, where sales are expected to decline between 1% and 2% this year. The company is facing intense competition in the U.S., and its focus on core products, particularly lounge and socialwear, has not paid dividends.

"While we continued to see positive momentum overall in our international regions ... we are disappointed with our U.S. business results and aspects of our product execution," CEO Calvin McDonald said in a call with analysts. “We have become too predictable within our casual offerings and missed opportunities to create new trends.”

Alongside the weakness in demand, Lululemon flagged that U.S. President Donald Trump’s tariffs, alongside the removal of the de minimis exemption, will continue to weigh on its margins.

The company expects a hit of $240 million on its gross profit in 2025 from the twin blow, despite mitigation efforts. It also expects these factors to have a $320 million impact on its operating margins in 2026.

The Trump administration scrapped the de minimis exemption policy, which allowed tariff-free imports for parcels valued under $800, on Aug. 29, dealing a blow to retailers like Lululemon. The company ships two-thirds of its orders from Canada, and a bulk of them were eligible for the exemption.

“We intend to increase new styles as a percentage of our overall assortment from the current 23% to approximately 35% next spring. We will continue to gauge guest behavior and adjust this penetration in future seasons based upon their response,” McDonald said.

Its second-quarter revenue grew 7% to $2.53 billion and came in line with estimates.

One Stocktwits user said the selloff was an overreaction and the stock will ‘fly’ after the Federal Reserve lowers interest rates.

Another trader suggested that the company could follow American Eagle Outfitters' lead by appointing Sydney Sweeney for an advertisement campaign.

Lululemon stock has fallen 46% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)