Advertisement|Remove ads.

Why Did Mobileye Stock Surge 8% Pre-Market Today?

- The latest deal for Surround ADAS technology expands the company’s expected delivery to over 19 million EyeQ6H-based systems.

- Mobileye Surround ADAS combines AI-driven software with up to 11 sensors, including multiple cameras and radars.

- Barclays has upgraded Mobileye stock to ‘Overweight’ from ‘Equal Weight’.

Shares of Mobileye (MBLY) surged over 8% in premarket trading on Monday after the company announced that a U.S.-based automaker has selected its EyeQ6H chip to power future hands-free highway driving features across millions of vehicles worldwide.

The latest deal expands Mobileye’s project delivery expectations for its Surround ADAS technology to over 19 million EyeQ6H-based systems. The U.S. automaker plans to include Surround ADAS as standard equipment on a wide range of mainstream and premium vehicles built on software-defined platforms.

“Leveraging the EyeQ6H as a powerful central processor for ADAS enables better performance, increased features and greater flexibility to automakers and their customers, all at a lower cost.”

- Amnon Shashua, President and CEO, Mobileye

Mobileye Surround ADAS combines AI-driven software with up to 11 sensors, including multiple cameras and radars, to deliver hands-free, eyes-on highway driving up to 81 mph.

The system includes automated lane changes, traffic jam assist, and advanced safety features such as blind spot detection, pedestrian detection, evasive maneuver assist, and driver monitoring.

Barclays Sees 40% Upside

Barclays has upgraded Mobileye stock to ‘Overweight’ from ‘Equal Weight’, signaling growing confidence in the company’s potential within the autonomous vehicle market. The firm set a price target of $16, slightly lower than the previous $17, implying a potential 40% upside as of Friday’s stock price.

The firm said that current investor sentiment around the company is "quite depressed," creating what it sees as an attractive risk/reward scenario at current stock levels. Barclays believes Mobileye is well-positioned to benefit from the growing autonomous vehicle trend, as traditional automakers increasingly hedge their bets against competitors like Tesla (TSLA).

How Did Stocktwits Users React?

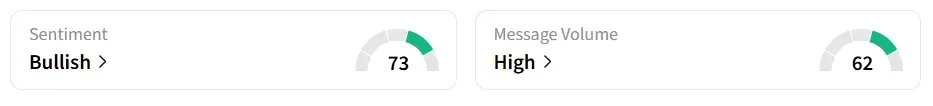

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory, and message volume shifted to ‘high’ from ‘normal’ levels in 24 hours.

MBLY stock has declined by over 48% in the last 12 months.

Also See: Why Is QXO Stock Surging Over 8% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)