Advertisement|Remove ads.

Why Did NVRI Stock Surge 34% In Premarket Today?

- Post deal completion, Enviri will spin off its Harsco Environmental and Rail units into a new publicly traded company called New Enviri.

- The deal will see Enviri’s shareholders receive $14.50 to $16.50 per share.

- Enviri plans to use $1.35 billion to pay debt.

Shares of Enviri Corp. (NVRI) surged 34% and are on track to hit their highest since November 2021 in premarket trading on Friday after the company signed an agreement to sell its Clean Earth unit to French environmental services firm Veolia for $3.04 billion.

Clean Earth is a waste management company that also deals with hazardous waste. It serves multiple industries, including technology, energy and pharma.

Deal Details

The deal will see Enviri’s shareholders receive $14.50 to $16.50 per share. Enviri will also spin off its Harsco Environmental and Rail units into a new publicly traded company, New Enviri, with shareholders receiving 0.33 New Enviri shares for each Enviri share they own.

The spin-off will occur after the Clean Earth sale is finalized, which is expected by mid-2026. The company projects that roughly 28 million New Enviri shares will be outstanding following the transaction.

Enviri plans to pay down about $1.35 billion in debt upon completion of the transaction.

Management Changes

Enviri’s current Senior Vice President, Russell Hochman, will assume the role of President and Chief Operating Officer of the company with immediate effect. After the spin-off, Hochman will become CEO of New Enviri, leading the Harsco Environmental and Rail businesses. Chairman and CEO Nick Grasberger will remain with Enviri through the Clean Earth sale.

What are Stocktwits Users Saying?

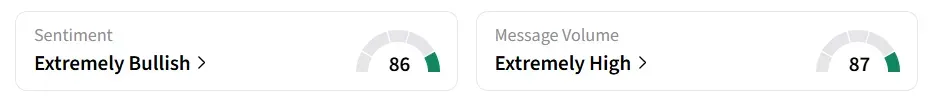

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘neutral’ in the previous session, amid ‘extremely high’ volumes. At the time of writing, NVRI was also among the top trending tickers on the platform.

One user is expected to open a short position if the stock rises above $19. It is currently at $18.2.

NVRI stock has seen significant buying interest so far this year, gaining over 73%.

Also See: Foxconn To Pour Up To $5B Into US Plants After Striking Servers Deal With OpenAI

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)