Advertisement|Remove ads.

Robinhood Stock Rally Shows No Signs of Cooling As Assets Top $300B: Traders Pile Into Stocks, Options, Crypto

Robinhood Markets Inc.’s stock (HOOD) rose marginally in extended trading on Thursday after the company’s total platform assets soared above $300 billion in August.

The rapidly evolving retail trading platform has been in the spotlight over the past few weeks with numerous product launches, expanding presence in international markets, and news of its stock being inducted into a key benchmark index.

On Thursday, Robinhood said total assets on its platform reached $304 billion at the end of August, supported by $4.8 billion in net deposits during the month, equal to a 19% annualized growth rate.

The company reported 26.7 million funded accounts, though growth was offset by the required closure of about 180,000 low-balance accounts. Over the past year, net deposits totaled $61.6 billion, up 43% from August 2024.

Trading activity included $199.2 billion in equity volumes, 195.5 million options contracts, and $28.1 billion in crypto trading across Robinhood’s app and its Bitstamp exchange. Margin balances stood at $12.5 billion, while customer cash sweep balances reached $34.1 billion. Robinhood also generated $53 million in securities lending revenue in August.

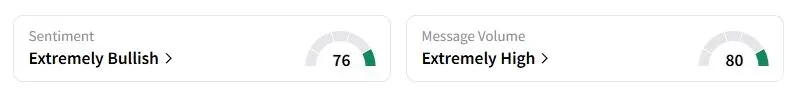

Retail sentiment on Stocktwits about Robinhood was ‘extremely bullish’ territory late Thursday.

The firm noted that equity notional trading volumes were up 107% to $199.2 billion, with options contracts trading rising 33%. Bitstamp Exchange, which Robinhood acquired in June, saw a 21% surge in cryptocurrency trading volume.

“The market wanted confirmation that HOOD deserves to be 120+. August metrics confirmed it,” one user wrote.

Earlier this week, Robinhood unveiled a range of new tools and features, including short selling, futures trading, and artificial intelligence integrations, all designed to deepen user engagement.

The company also launched a new social media platform for its active retail trading community, ‘Robinhood Social’, which is expected to debut in early 2026 and has already drawn praise from Wall Street analysts.

Robinhood stock has more than tripled this year, amid volatility in equity markets and a rally in cryptocurrency prices. The stock is poised to join the S&P 500 benchmark index, which will provide additional investment.

Also See: Why Did CleanCore Solutions' Stock Rise After Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)