Advertisement|Remove ads.

Why Did Rocket Lab Stock Fall After-Hours Today?

Rocket Lab USA (RKLB) stock slipped 3.9% in extended trading on Monday after the company agreed to an at-the-market equity offering program of up to $750 million.

The launch services provider has appointed BofA Securities, Cantor Fitzgerald & Co., and KeyBanc Capital Markets to carry out the sale.

Rocket Lab intends to use the proceeds from the offering to fund growth, including potential future acquisitions. It may also use some of the proceeds to fund its acquisition of Mynaric, the German optical communications firm, which Rocket Lab agreed to buy in a deal worth up to $150 million.

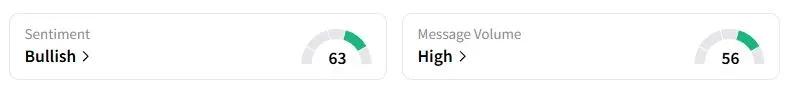

Retail sentiment on Stocktwits about Rocket Lab was still in the ‘bullish’ territory at the time of writing.

Rocket Lab is also terminating its prior atm offering of $500 million, which was announced in March. The company has so far raised about $396 million through the program.

At-the-market offerings are a common tool for companies to raise money when their valuation is soaring. Unlike a fixed-price share sale, they provide businesses with the flexibility to sell shares at the market price over time.

Rocket Lab's stock has more than doubled this year, amid increased optimism over its launch contracts and possible participation in major defense projects such as the Golden Dome initiative.

“How can anyone be bearish here? They have never been reckless with offerings. [It] could be another acquisition coming,” one user wrote on Stocktwits.

“As valuation goes up, it is the lowest cost means to secure funding, and they’ve proven time and time again they don’t raise to pay down unmanaged debt, they raise to grow and expand,” another user said.

Its larger competitor, SpaceX, was also reportedly looking to raise funds by selling shares at a valuation of $400 billion. The company is currently testing its biggest launch vehicle, Starship, which will be used for future missions to the Moon and Mars.

Rocket Lab is also preparing to launch a bigger rocket named Neutron by the end of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)