Advertisement|Remove ads.

Why Did Rubico Stock Plummet To Record Lows Today?

- Shares of Rubico tanked 55% on Wednesday morning.

- The company priced its $7.5 million underwritten public offering at $0.609 per unit

- Rubico said that the warrants can also be exercised on a zero-cash exercise option.

Shares of Rubico Inc. (RUBI) tanked 55% to a record low on Wednesday morning after the company announced the pricing of its $7.5 million underwritten public offering.

The shipping company priced the public offering of 12,315,270 units at $0.609 per unit, equal to Tuesday’s closing price.

The Offering

Each unit includes one common share and one Class A warrant to purchase a common share. The warrants, exercisable at $0.609 per share immediately, will expire one year from the date of issuance. The price will be adjusted to 70% and 50% of the initial price on the fourth and eighth trading days after the offering closes, respectively. The company said that the warrants can also be exercised on a zero-cash exercise option.

Rubico expects to raise gross proceeds of about $7.5 million, with closing anticipated on November 6. The company did not specify how it intends to use the proceeds.

What Are Stocktwits Investors Saying?

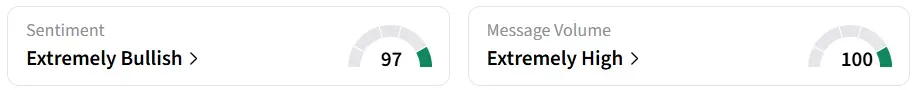

Despite the significant decline in the stock price, retail sentiment remained in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes.

A Stocktwits user is eyeing a further decline before taking fresh positions.

Another user highlighted the company’s decision to post the update after Tuesday’s close.

Rubico, an international crude oil shipping company spun off from TOP Ships, was listed on the Nasdaq in July this year. As part of the spinoff, TOP Ships transferred the ownership of two 2021-built Suezmax tankers – Eco Malibu and Eco West Coast to Rubico.

Since its listing, RUBI shares have declined nearly 90%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)