Advertisement|Remove ads.

Why Did Venture Global Stock Plunge After-Hours?

Venture Global (VG) stock fell 12.6% in extended trading on Thursday after the company revealed in a regulatory filing that it has lost an arbitration battle with BP over its failure to supply liquefied natural gas from its Calcasieu Pass facility.

The company stated that the International Court of Arbitration of the International Chamber of Commerce ruled it had breached its obligations by failing to declare the start of commercial operations at the Calcasieu Project on time and by not acting as a “reasonable and prudent operator” under its agreement with BP.

Among other remedies, the London-listed BP is seeking damages in excess of $1 billion, as well as interest, costs, and attorneys’ fees.

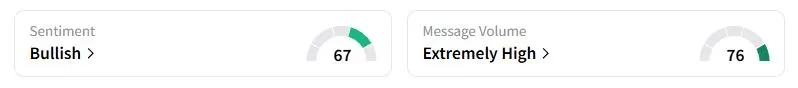

Retail sentiment on Stocktwits about Venture Global was still in the ‘bullish’ territory at the time of writing.

The dispute stems from Venture Global’s decision to sell LNG cargoes from the plant to spot customers in 2022, when prices of the commodity soared after Western sanctions on Russia following its invasion of Ukraine. The company’s customers, who have inked long-term contracts, alleged that the company is wrongfully profiting from selling LNG in the spot market instead of sending it to them at lower prices.

Venture Global has maintained that it was allowed to carry out the sales as commercialization of Calcasieu Pass could not be completed due to an issue with a power island. The energy firm had prevailed in a similar dispute with Shell earlier this year.

“The company is disappointed by the arbitration tribunal’s decision in the proceeding with BP, which it believes contradicts the decisive findings in the prior arbitration involving Shell and the facts verified by independent third parties and regulatory agencies,” Venture Global said in a statement. The Calcasieu Project began operations commercially in April.

It pledged to look at all available options in response to the tribunal’s ruling and added it will continue to “vigorously defend” its position.

Some retail traders were wondering what the reason was behind the outcome.

“The question if you’re long is, does this get more of a beat down at the open tomorrow? While the award hearing isn’t until 2026, does this lead to other negative settlements or embolden others to file claims?” another user wrote.

Venture Global stock has fallen nearly 50% since its debut in January.

Also See: Why Did Park Aerospace Stock Decline Nearly 4% After-Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)