Advertisement|Remove ads.

Copper Price Rally Pushes This Stock To 11-Month High – A SEBI Analyst Sees Further 25% Upside Potential

Shares of Hindustan Copper surged as much as 6.9% to their highest in over 11 months on Thursday. The stock has been on a strong rally lately, declining in just four sessions so far this month. During this September rally, the stock has gained 43.5%.

What’s Driving Hind Copper Rally?

Copper prices surged sharply, driven by concerns over supply and geopolitical risks in major producing regions. Benchmark three-month copper on the London Metal Exchange jumped 3.9% to $10,400 per metric ton, marking a 15-month high, after Freeport-McMoRan declared force majeure at its Grasberg mine in Indonesia, the world’s second-largest copper source.

Force majeure is a contract clause that frees parties from liability for unforeseeable, catastrophic events, such as natural disasters, allowing them to avoid penalties for non-fulfilment, with its scope varying across jurisdictions.

The announcement followed a September 8 accident at the mine, which killed two workers and left five missing after a massive mudflow involving roughly 800,000 metric tons of material. According to reports, the force majeure is expected to slash Freeport’s copper sales by about 4% in the third quarter. Grasberg reportedly accounts for around 3% of global copper production.

The copper spot price has rallied close to its all-time high of $11,104.50 per ton, reached in May 2024.

Earlier this week, Hindustan Copper’s shares rallied after the company executed the Rakha mining lease deed in Jharkhand for a period of 20 years.

What Is The Retail Mood?

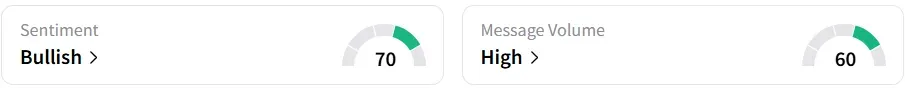

Retail sentiment on Stocktwits has remained ‘bullish’ for nearly a month. It was ‘neutral’ prior to that.

The stock has also been a subject of ‘high’ chatter this month. It was among the top 10 trending stocks on the platform.

Hindustan Copper shares have gained 32% so far this year.

Technical Outlook

Hindustan Copper’s stock has formed a cup & handle pattern on the weekly chart, confirmed by a strong bullish candle, noted SEBI-registered analyst Financial Sarthis.

The stock has broken out above the key support level of ₹289, signaling potential upside, while a drop below ₹289 would indicate breakdown risk, he said. Institutional buying interest is evident from the massive surge in volume accompanying the breakout.

The analyst recommends picking up fresh positions at ₹325 - ₹330 or on minor dips, with a stop-loss at ₹285. Financial Sarthis sees the stock potentially climbing to ₹351 in the near term and then to ₹415.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)