Advertisement|Remove ads.

Array Technologies Stock Declines To Over Two-Year Lows But Retail Sentiment At One-Year High: What's Happening?

Renewable energy firm Array Technologies shares declined 23% on Friday to hit over two-year lows, after the firm revised down its full-year earnings outlook during its second-quarter earnings announcement.

The renewable energy company said it now expects revenue to be in the range of $900 million to $1.00 billion compared to a previous guidance of $1.25 billion to $1.40 billion. The firm expects adjusted operating profits to be in the range of $185 million to $210 million versus an earlier guidance of $285 million to $315 million. Adjusted net income per share is estimated to come in at $0.64 to $0.74 compared to an earlier estimate of $1.00 to $1.15.

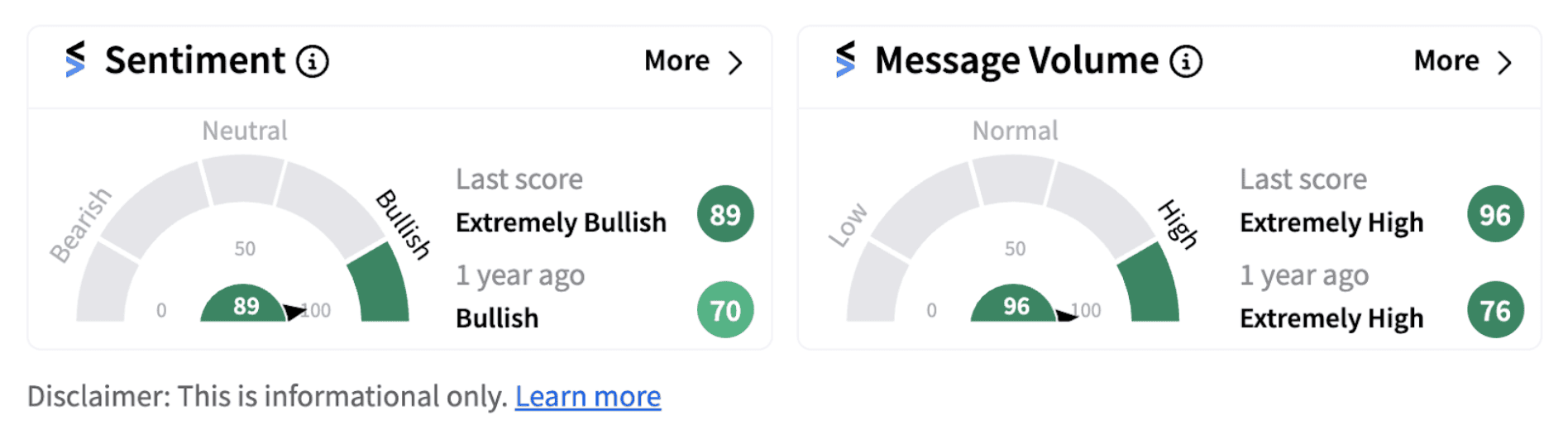

Despite a souring stance of Wall Street, retail investors on Stocktwits inched-up their sentiment on the stock to the ‘extremely bullish’ territory (89/100), jumping to a one-year high from the ‘bearish’ zone a day ago. The move was accompanied by ‘extremely high’ message volume.

The renewed retail optimism followed the upbeat earnings and revenue disclosed by the firm for the quarter. Earnings per share (EPS) came in at $0.20 versus an estimate of $0.10 while the firm declared revenues at $255.77 million compared to an estimate of $228 million.

Chief Executive Officer, Kevin Hostetler said the firm’s orderbook remains healthy at over $2 billion. “Adjusted gross margin continued to be strong at 35%, which included incremental 45x benefits through June 30, 2024 that were not previously factored in our guidance,’ he said.

Management clarified that the reduction in revenue outlook came in the backdrop of customers continuing to report struggles with short-term dynamics that are causing project delays.

Array Technologies also pointed out that the recent AD/CVD petitions and the interpretation of the new IRA domestic content elective safe harbor table are new factors that have led to some uncertainty in the U.S. market, changing timelines for some customers’ projects. Moreover, the rapid devaluation of the Brazilian real caused developers to delay projects in Brazil, it said.

Stocktwits users, however, are focusing on the long-term prospects of the firm while betting on the potential drop in interest rates in the coming times. The 57% year-to-date (YTD) drop in the stock price has also attracted bottom-fishers to the party.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stellantis_ram_truck_OG_jpg_78d19a0ac9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nvidia_logo_OG_jpg_127f9961ef.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/drishti-ias-2025-10-b2c6f076ec8eb54d4877c3b0eef0771b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)